Jacopo Torriti and Martin Green

Background

The UK Government’s Clean Growth Strategy (CGS) places significant importance on flexibility in electricity demand. Flexibility is important because the integration of intermittent renewables in the supply mix, as well as high penetration of electric vehicles and electric heat pumps, will challenge the balance of demand and supply. The CGS considers demand flexibility will need to play a vital role for a stable electricity system as existing approaches to balancing are inadequate. In this context, there are opportunities to reduce the costs of electricity if smart systems and battery storage are used to flex demand at times when it is high. In a nutshell, demand-side flexibility is portrayed in the CGS as a win-win solution, as consumers will help balance the grid in return for lower bills if they take advantage of smart appliances and smart tariffs.

The key part of the CGS on demand-side flexibility is in ‘Delivering Clean, Smart, Flexible Power’. This points to investments from the UK Government of £265 million between 2015 and 2021 in research, development and deployment of smart systems to reduce the cost of electricity storage, advance innovative demand-side response (DSR) technologies and develop new ways of balancing the grid. The move to low carbon generation will increase the variability of electricity supply, as key technologies depend on both weather (e.g. wind speed) and daily and annual cycles (e.g. solar radiation).

The general view is that a more flexible system is required. Most of the principles underpinning the vision for demand flexibility are set out in the 2017 smart systems and flexibility plan (BEIS and Ofgem, 2017). The plan is based on a report that shows a system using DSR and distributed storage to provide flexibility would be between £17bn and £40bn cheaper over the period to 2050 compared to a system that relies on enhancing flexibility through interconnectors and pumped hydro storage (Carbon Trust & Imperial College, 2016).

This chapter focuses on drawing together existing research evidence to inform an independent analysis of the flexible energy demand aspects of the CGS. Given the importance and relative novelty of flexibility at the scale envisaged in the CGS, the policy implications need to be thought through carefully and based on evidence. Research needs to ask fundamental questions around whether flexibility benefits systems as well as consumers. The two key aims of this chapter are: (i) to assess whether different/ additional policies and measures will be required, and (ii) to identify important research gaps to be filled by CREDS through co-created research. In order to deliver these two aims, this chapter compares the overall level of flexibility forecast in the CGS with other studies; presents alternative approaches to achieve flexibility; and suggests areas of research in this emerging field. It is concluded that moving to higher levels of demand flexibility will require radical shifts. This calls for more clarity at the planning stage on the following questions: will flexibility be achieved through technology interventions alone? What role do smart tariffs play at different levels of penetration? Critically, research is needed to assess the win-win proposition stated in the CGS, i.e. that consumers and the electricity grid will both benefit from the introduction of greater flexibility.

This chapter questions how ambitious the flexibility target in the CGS is compared with existing studies; describes what is planned in the CGS; proposes a radically different Government approach on flexibility; and concludes by identifying three significant research gaps.

How much flexibility? An unambitious target

The CGS presents figures on levels of flexibility for the future based on BEIS’ 2032 pathway calculations for an 80% renewables future. Electricity demand is projected to increase by 3% (10 TWh), with an increase in peak demand of 4% (2.8 GW), by 2032 from 2016 levels. The extra capacity and flexibility is proposed in the CGS to originate from DSR (4.9 GW), storage (0.3 GW), clean generators (0.5 GW) and fossil fuels (1.2 GW). The increase in peak demand is argued to arise from the uptake of electric vehicles and heat pumps. This allows for some implicit DSR (i.e. the effect of consumer response to time-dependent pricing), which would consist of shifting to overnight charging for most electric vehicles and smart controls of heat pumps.

This proposed increase in DSR is a relatively unambitious target. National Grid estimates that 2.7 GW of DSR capacity, equivalent to two large power stations, participated across their portfolio of balancing products and services in 2017 (National Grid, 2017). A report by the Association for Decentralised Energy suggests that by 2020 DSR could provide 4.5 GW thanks to 2.8 GW from industrial demand flexibility and 1.7 GW from commercial and public sector demand flexibility (ADE, 2016). A report by Element Energy estimated that the non-domestic potential of DSR in 2011 was in the range of 1.2–4.4 GW (Element Energy, 2012). The scenarios prepared by the Carbon Trust and Imperial College suggest DSR deployment of between 4.1–11.4 GW by 2030.

This variation highlights the opportunities, yet clear uncertainty, in the DSR potential offered by the electrical assets in UK businesses.

Figure 12 shows future levels of DSR in the UK according to different studies and reports. The size of the bubble represents how large forecast DSR levels are and the position of the bubble indicates the year to which the forecast applies. The red line represents the trend and, notably, the purple bubble (i.e. CGS) has the lowest ambition in terms of DSR penetration.

Image description

- 2011: Element Energy: non-domestic potential 2.8 GW

- 2017: National Grid: Existing DS 2.7 GW

- Looking forward to 2020: ADE: Flexibility on demand – giving customers control to secure our electricity system 4.5 GW

- Looking forward to 2030: Carbon Trust and Imperial College: Analysis of electricity flexibility for Great Britain 7.75 GW

- Looking forward to 2032: BEIS: Clean Growth Strategy 4.9 GW

However, in any highly renewable future, flexibility will be needed to meet a variety of requirements, including capacity adequacy under stress conditions, but also the ability to increase, decrease, or shift electricity demand frequently.

Actions planned in the CGS

The 2017 Smart System and Flexibility plan outlines 29 actions under three areas (removing barriers to smart technologies; smart homes and businesses; and markets which work for flexibility).

With regards to market arrangements, the actions are aimed at amending issues preventing DSR participation, including ensuring that storage and demand flexibility participate on a level playing field in the Capacity Market; delivering efficient access for independent aggregators to the Short Term Operating Reserve (STOR); simplifying ancillary services and making them more transparent; changing network charges; and improving stakeholder engagement in flexibility.

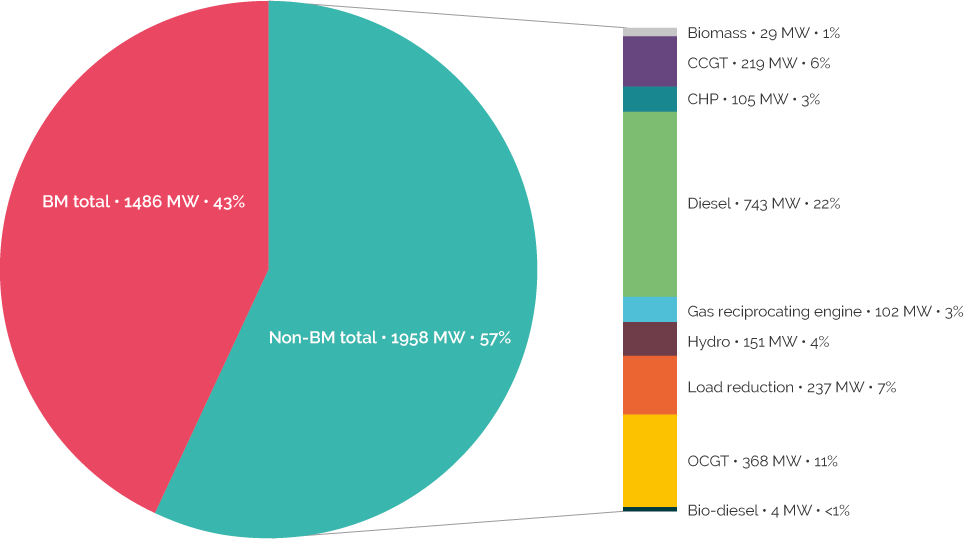

Image description

Balancing Mechanism total 1486 MW / 43%, Non-Balancing Mechanism total 1958 MW / 57%. Non-BM made up of:

- Biomass 29 MW / 1%

- CCGT 219 MW / 6%

- CHP 105 MW / 3%

- Diesel 743 MW / 22%

- Gas reciprocating engine 102 MW / 3%

- Hydro 151 MW / 4%

- Load reduction 237 MW / 7%

- OCGT 368 MW / 11%

- Bio-diesel 4 MW / <1%

Figure 13 provides a breakdown of the resources used by the System Operator (National Grid) to balance supply and demand at different times. The Balancing Mechanism (BM) uses price signals to incentivise generators to come on or off the network. Outside the BM are several other options that can be deployed quickly, for example through STOR. The figure shows that 237 MW (7% of overall STOR capacity) is from load reduction (which in this case is likely to also include load shifting DSR, as the National Grid uses the term ‘load response’ to cover both load shifting and ‘turn-down’) (National Grid, 2017). In addition, DSR contributes to the provision of adequate capacity. The turn-down DSR only Capacity Market auction in March 2017 resulted in Ofgem awarding 300 MW of contracts to DSR (Ofgem, 2017). These two MW figures cannot simply be added as each could be provided from the same assets. Therefore, based on the figures obtained from published reports and assuming additional amounts have been provided via other sources, a rough estimate of turn-down DSR is between 300-500 MW. This represents only 6-10% of what is required to meet the CGS target of 4.9 GW of DSR. A much more radical approach is required for flexible demand as explained in the section below.

Changing approach completely on flexibility

The CGS and the ‘Smart systems and flexibility plan’ can be seen as the first positive steps towards the inclusion of demand-side flexibility in a low carbon energy system. However, in order to accommodate high levels of flexibility the actions they put forward will be insufficient. This section puts forward more radical suggestions for the integration of flexible demand in a low carbon future.

If flexibility is to play a major role, the rules have to be changed entirely

There is no specific market programme for flexibility in the UK and DSR is instead contained within the current electricity balancing services of the Electricity System Operator (a company in the National Grid Group). While STOR is a means of providing DSR, its current structure provides a number of barriers to uptake and discourages investments in DSR. These market rules favour generator-based services and restrict turn-down solutions. Battery storage is currently charged fees for using the energy network as both a demand customer and a generator, i.e. both when drawing power from and discharging power back to the system.

| Barrier Category | Barrier | Research Source | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | ||

| End user | Lack of DSR awareness / understanding | x | x | x | x | ||||

| Impact Concerns | x | x | x | x | x | ||||

| Risk aversion / trust issues | x | x | x | ||||||

| Regulatory | Regulations unfavourable for DSR | x | x | x | x | x | x | x | |

| Current regulations preventing DSR | x | ||||||||

| Technical | Lack of ICT infrastructure | x | x | ||||||

| Cost of enablement | x | x | x | ||||||

| Equipment not suitable for DSR | x | x | x | x | |||||

| Market | Lack of DSR market options | x | x | x | x | ||||

| Insufficient financial incentives | x | x | x | x | x | ||||

| Traditional large generation bias | x | x | x | ||||||

| Source Key: 1 (Strbac, 2008) Demand Side Management: Benefits and Challenges 2 (Owen, Ward, & Pooley, 2012) What Demand Side Services Could Customers Offer? 3 (Cappers, MacDonald, Goldman, & Ma, 2013) An Assessment of Market and Policy Barriers for Demand Response Providing Ancillary Services in U.S. Electricity Markets 4 (Warren, 2014) A Review of Demand-Side Management Policy in the UK 5 (Nolan & O’Malley, 2015) Challenges and Barriers to Demand Response Deployment and Evaluation 6 (Olsthoorn, Schleich, & Klobasa, 2015) Barriers to Electricity Load Shift in Companies: A Survey-based Exploration of the End User Perspective 7 (SEDC, 2017) Explicit Demand Response in Europe: Mapping the Markets 2017 8 (The Energyst, 2017) Demand-side Response: Shifting the Balance of Power: 2017 Report |

|||||||||

Box 1 – key barriers for DSR uptake:

The research literature on DSR identifies many different types of barriers, which fit into the four main categories of: end user, regulatory, technical, and market (Table 1). The end use barrier focuses on issues that end users have direct influence over, such as lack of interest in DSR. Examples of regulatory barriers include the fact that several Governments do not yet acknowledge the role of independent DSR aggregators in enabling uptake. One of the major technical barriers is end user equipment being deemed as unsuitable for DSR. Market barriers consist primarily of the absence a specific market programme for DSR.

National Grid’s estimate of the DSR contribution to overall balancing (2.7 GW in 2017) is probably an overestimate as it includes smaller scale diesel generation, which is not truly DSR as diesel generators are not associated with an energy user; rather, they are dedicated supply-side assets as illustrated in Figure 13. Considering only user-led demand management and on-site generation participating in the Balancing Services, the amount of DSR used for balancing the system in 2017 was approximately 700 MW. Changing the rules entirely might involve, for instance, the development of a flexibility market which can place a higher value on more flexible resources (DECC, 2013).

The capacity market is an ineffective instrument to provide flexibility

The UK’s Electricity Market Reform policy aims to deliver low carbon energy and reliable supplies. A key mechanism this uses is the creation of a Capacity Market that “provides a regular retainer payment to reliable forms of capacity (both demand and supply side), in return for such capacity being available when the system is tight” (DECC, 2013). While this policy specifically includes DSR and storage as a measure for meeting the mechanism’s aims, it has been criticised for restricting participation, arbitrarily limiting contract lengths and offering only uncertainty about storage capacity during transitional arrangements (Yeo, 2014). The Capacity Market only offers one-year storage contracts compared with the up to 15-year terms available for fossil fuel generator contracts. The problem with supporting flexibility through the Capacity Market is that the latter was originally intended for security of supply and, where auctions award long-term contracts, to help de-risk power station construction. Balancing the electricity system depends on two conditions: capacity adequacy, i.e. enough power generating capacity to meet demand; and flexibility, i.e. the system’s responsiveness to changing conditions. In the past, capacity adequacy has been the dominant concern of policymakers and the Transmission System Operator. However, the structural shift to renewables is making flexibility a priority.

Following the ruling by the European Court of Justice, the Capacity Market is currently in a ’standstill period’. The last auction for delivery in winter 2019 cleared at £6 per kW. This very low price reflects the high level of capacity, 10.7 GW, bidding for a target of 4.9 GW, although around 5.8 GW was awarded. The Capacity Market standstill provides an opportunity to think collectively about its rules. Is a Capacity Market really needed? If a Capacity Market needs to be in place, we suggest that different rules in terms of size, duration and notice periods should be considered in order to ensure participation of flexibility assets (Grunewald & Torriti, 2013).

Demand turn-up should not be isolated – it will become a vital part of the system affecting wholesale prices

The CGS defines the need for flexible capacity (6.9 GW) as the need to meet peak demand (4.9 GW in addition to current peak demand). This mainly relates to peaks in winter evenings, which traditionally are associated with the lowest margins between supply and demand. However, in a low carbon future, flexibility will need to be integral to the system, not only a small resource to be drawn upon in an emergency as an aid to capacity adequacy. For instance, electricity wholesale markets in Germany and GB have, on several recent occasions, moved into negative prices, which is to say that buyers are paid to use power by sellers. Examples of sunny and windy Sundays in which demand is low and renewable generation is high abound and will increase the need for increasing demand (‘turn-up’) (Torriti, 2016). Some examples of questions currently unaddressed in the CGS include the following: are there monetary benefits for consumers in relation to demand turn-up; will these be seized be specific categories of consumers? In research, as well as in policy, there needs to be greater clarity over the role of demand turn-up.

The CGS does not address how much flexibility will come from implicit DSR

Over the past couple of decades, flexible electricity demand, in the form of turn-down and load-shedding has predominantly taken place through the participation of industrial and large commercial users (This has been explained as a reflection of interruptible programmes and aggregators having higher incentives for higher capacity in Torriti et al, 2010). Whilst there are studies which suggest that much more flexibility is technically and economically available from industry, ambitious targets will need to consider various forms of flexibility from different types of consumers. Moreover, ‘implicit’ demand response, in the form of time of use (ToU) and other time-dependent tariffs is generally seen as a way to increase flexibility in residential use. The CGS is not explicit about the levels of flexibility to be derived from the residential sector. This may be due to uncertainties about the social and political acceptability of a system in which tariffs are no longer flat. The timing of electricity use by individual households is currently estimated using average ‘profiles’. The introduction of smart meters provides an opportunity to collect more detailed data and use this to allocate electricity to suppliers based on a customer’s actual demand in each half-hour. Whilst moving away from profiling to half hourly metering does not imply that there will have to be variable tariffs, some of the main benefits of smart meters (e.g. reducing the need for new generation and network capacity) are supposed to be associated with the introduction of variable tariffs. The impact of more cost-reflective pricing will vary between consumers and this will need to be better understood.

Areas in which different and/or additional policies and measures will be required

We recommend that BEIS should create a common policy for DSR in order to maximise the flexibility potential of electricity demand. DSR to date has been mainly an operational decision in the hands of National Grid, relying mostly on the flexibility of industrial and commercial end-users. National Grid is currently revisiting the services in which DSR operates. However, the next step, possibly in the next two years is for BEIS to introduce a common GB policy, which would encourage uptake from residential end-users with significant implications for grid balancing and cost reduction.

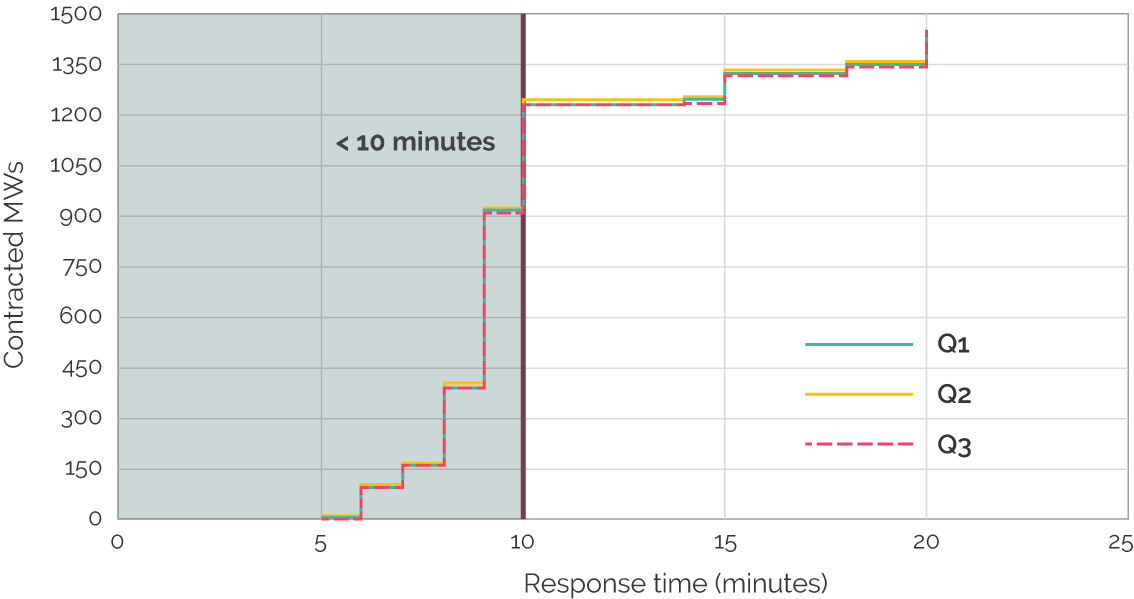

The policy should improve the current rules of the game of DSR (as highlighted in Box 1) as they significantly prevent participation from smaller energy users and leads to limited participation of load turn-down which requires more than 10 minutes’ notice (see Figure 14).

- We recommend that consumers should be enabled to benefit from the reform of the pricing settlement. Ofgem’s recent decision to move to half-hourly settlement enables suppliers to know how much their customers consume every half hour. Hence, suppliers could offer tariffs based on dynamic pricing, such as ToU tariffs, which have the potential to shift demand away from times when demand is higher. A reduction in the amount of consumption at peak times should reduce the need for investment in new generation and network capacity and hence bill payer cost.

- We recommend that the National Grid Capacity Market should aim to increase storage and DSR participation, extending the one-year contracts under transitional arrangements for a longer time period. This will decrease investors’ uncertainty and boost the uptake of storage technologies. BEIS should consider contract duration as part of their review of Capacity Market rules. BEIS should review Capacity Market rules also in terms of the balance between capital expenditure (Capex) and operational expenditure (Opex). The current low Capex and high Opex system means that capacity payments are more certain than market revenue, investors are incentivised to build diesel and gas engines, at the expense of low carbon and more efficient gas solutions.

- We recommend reform of the current system of double charging for storage. To avoid this, the Ofgem Access Framework should be modified to develop clearer definitions of capacity rights as distinct from connection capacity. In practice, changes to the Electricity Act 1989 will need to include the definition of storage as a subset of generation asset class and not as end consumers of energy.

Research gaps

This brief review of the CGS points to three main areas in which further research is needed.

First, any transition brings about change that could potentially disrupt the more vulnerable and strengthen those who have capital means. If the transition to a low or zero carbon economy is to be equitable, there will be a need for research on how vulnerable consumers will be impacted. An example comes from ToU tariffs, which in principle offer significant potential benefits to the system by enabling responsive electricity demand and reducing peaks. However, the impact of more cost-reflective pricing will vary between consumers. In particular, those who consume electricity at more expensive peak periods, and who are unable to change their consumption patterns, could end up paying significantly more. Understanding the distributional effects of ToU tariffs becomes vital to ensuring affordability of energy bills, while making demand more flexible. Research will shed light not only on average responses to changes in prices, but also on how people’s flexibility varies based on the time of the day, location, work and social commitments.

Second, the CGS views technologies as (the only) enablers of higher flexibility. Attempting to engineer solutions may not lead to the desired effects of higher flexibility unless there is a deep understanding of how everyday life changes along with the new technologies. If such solutions and interventions are only developed to meet current ‘need’ and their business case assumes this ‘need’ is fixed, then the risk of developing rapidly obsolete and uneconomic interventions is high. Research can help understand the trajectories of change that must be considered and thus inform adaptive intervention design. Research is needed to understand, for instance, how electric vehicles and home battery storage might shape, and be shaped by, patterns of demand in people’s everyday lives.

Third, the CGS views flexibility as originating from DSR, storage, clean generation and fossil fuel generation. However, flexibility could be derived from a variety of actions and changes, some of which may originate from the non-energy sphere. The impact of electric vehicles is an obvious example of new possibilities for flexibility which has only gained currency in recent years. The decarbonisation of heat could provide fuel switching and other opportunities for flexibility. Similarly, flexibility could be the result of non-energy changes in society and technology. Research which breaks the boundaries of sectors could shed light on opportunities for flexibility beyond existing options. For instance, in the future flexible work arrangements and an increase in work from home might have implications for when and where energy is consumed and the types of flexibilities available at different scales.

References

Show all references

- ADE (2016). Flexibility on demand, Giving customers control to secure our electricity system, pdfOpens in a new tab

- BEIS and Ofgem (2017). Upgrading our energy system: smart systems and flexibility planOpens in a new tab

- Carbon Trust and Imperial College (2016). An analysis ofelectricity system flexibility for Great Britain, pdfOpens in a new tab

- DECC (2013). Electricity Market Reform (EMR)Opens in a new tab

- Element Energy (2012). Demand side response in the non-domestic sector, pdfOpens in a new tab

- Grunewald, P. and Torriti, J. (2013). Demand response from the non-domestic sector: early UK experiences and future opportunities. Energy Policy, 61: 423–429. doi: 10.1016/j.enpol.2013.06.051

- National Grid (2017). Non-BM Balancing Services Volumes and Expenditure.

- Ofgem (2017). Annual Report on the Operation of the Capacity MarketOpens in a new tab

- Torriti, J., Hassan, M. G. & Leach, M. (2010). Demand response experience in Europe: policies, programmes and implementation. Energy, 35 (4): 1575–1583. doi: 10.1016/j.energy.2009.05.021

- Torriti, J. (2015). Peak energy demand and demand side response. Routledge Explorations in Environmental Studies. Routledge, Abingdon, pp.172.

- Yeo, T. (2014). Matthew Hancock 090914 DSR Cap Market letter, pdfOpens in a new tab

Publication details

Torritti, J. and Green, M.S. 2019. 5 Electricity: making demand more flexible. In: Shifting the focus: energy demand in a net-zero carbon UK. Eyre, N and Killip, G. [eds]. Centre for Research into Energy Demand Solutions. Oxford, UK. ISBN: 978-1-913299-04-0

Banner photo credit: Alireza Attari on Unsplash