Donal Brown, Steve Sorrell and Paula Kivimaa

Summary

Improving energy efficiency, de-carbonising heating and cooling, and increasing renewable microgeneration in existing residential buildings, is crucial for meeting social and climate policy objectives. This paper explores the challenges of financing this ‘retrofit’ activity. First, it develops a typology of finance mechanisms for residential retrofit highlighting their key design features, including: the source of capital; the financial instrument(s); the project performance requirements; the point of sale; the nature of the security and underwriting the repayment channel and customer journey. Combining information from interviews and documentary sources, the paper explores how these design features influence the success of the finance mechanisms in different contexts. First, it is shown that a low cost of capital for retrofit finance is critical to the economic viability of whole-house retrofits. Second, by funding non-energy measures such as general improvement works, finance mechanisms can enable broader sources of value that are more highly prized by households. Thirdly, mechanisms that reduce complexity by simplifying the customer journey are likely to achieve much higher levels of uptake. Most importantly we discuss how finance alone is unlikely to be a driver of demand for whole-house retrofit, and so instead should be viewed as a necessary component of a much broader retrofit strategy.

1. Introduction

CO2 emissions from energy used in residential buildings result from space and water heating, and electricity used for cooling, lighting and appliances. These emissions constitute a significant proportion of total emissions in advanced economies (IPCC, 2014). Aside from more efficient appliances and behavioural changes, emissions from the existing building stock can be reduced by the retrofit of three main types of measure: improving the energy efficiency (EE) of the building fabric; adopting low carbon heating, ventilation and cooling technologies (HVAC); and building integrated electricity microgeneration, such as solar photovoltaics (PV) (CCC, 2013). Thus, in this paper ‘retrofit’ finance potentially includes funding for all three types of intervention.

The Intergovernmental Panel on Climate Change have set ambitious goals for the retrofit of buildings (50% energy reduction from 2050 baseline scenario (IPCC, 2014)), to keep global temperature rises below 2 °C as part of the 2015 Paris agreement. Since 1970 emissions from all buildings have more than doubled and in 2010 constituted around 19% of global carbon emissions (IPCC, 2014). Many retrofit measures deliver net cost savings or are cost effective,1 when compared to other climate mitigation measures (CCC, 2018, IEA, 2017). However, delivering these ambitious targets, will necessitate increasingly comprehensive ‘whole-house’ retrofits, involving multiple integrated building fabric, HVAC, and microgeneration measures (Brown, 2018).

Delivering the 2 °C scenario will require an estimated $31Tn of investment in buildings globally over the next four decades (IEA, 2013). A significant proportion of historical energy efficiency measures has involved self-financing by firms and households (IEA, 2017, Webber et al., 2015). However, an important source of EE investment in recent years in both Europe and North America (12% of total) has come from market based instruments such as supplier obligation policies, paid for by a levy on electricity and gas bills (IEA, 2017). These policies have typically delivered single home retrofit measures (Rosenow, 2012).

Achieving sufficient ‘whole house’ retrofits through supplier obligations alone could lead to significant increases in household energy bills (Kern et al., 2017), thus having a negative impact on low income households who do not undertake retrofit measures (Rosenow et al., 2013b). Whilst ‘fuel poverty’2 objectives could be better achieved through general taxation (Rosenow et al., 2013b), there is a need for effective, repayable finance mechanisms for the ‘able-to-pay’ segments (Freehling and Stickles, 2016).

In this paper, finance mechanisms are considered distinct from targeted subsidies, supplier obligations (IEA, 2017), or fiscal incentive schemes such as property tax breaks (Rosenow et al., 2014). A finance mechanism is thus defined as the provision of capital for retrofit measures through equity and/or debt that is repaid to the lender (Leventis et al., 2017). A range of retrofit finance mechanisms have been developed, in the European Union (EU) and USA. The features of and reasons for success of these alternative approaches are the main focus of this study.

A comprehensive study of finance mechanisms for domestic retrofit is largely absent from the academic literature – with most studies published being non-academic, having limited consideration for the specific issues of residential buildings, or involving a different unit of analysis, such as supplier obligations (Rosenow, 2012). Further, an empirical investigation of factors that contribute to household appeal and the cost of capital is presently lacking. The role of different types of financing and their impact on projects remains somewhat of a ‘black box’ in the energy studies field more generally. This paper aims to open up the features of alternative finance mechanisms, and to understand the extent to which they can promote the uptake of whole-house retrofit -drawing on selected examples in Europe and North America.

This paper is structured as follows. Section 2 provides background to the context of residential retrofit and reviews the literature on retrofit finance. Section 3 introduces the conceptual framework for the features of finance mechanisms along with the cost of capital. Section 4 outlines the methodology. Section 5 introduces a new typology of retrofit finance mechanisms, while Section 6 describes how these mechanisms differ according to the framework. Section 7 discusses the findings. Section 8 concludes and provides recommendations for policy and research. A glossary of key financial terminology used in the paper is provided in Table A1 in the Appendix.

2. Background on energy efficiency, residential retrofit and finance

Residential retrofit produces a range of environmental, social and economic benefits, making it an important area for academic and policy research (Kerr et al., 2017). Energy savings from residential retrofit and a shift away from fossil fuel-based heating and cooling have the potential to significantly mitigate anthropogenic climate change. The IPCC (2014) estimate that, through improved EE, energy use from buildings could be stabilised by mid-century, compared to a current baseline where this is set to double. Thus, the EU has set a target of 27% improvement in EE by 2030 (EC, 2014) and the revised Directive for the Energy Performance of Buildings has set a near zero-energy aspiration for the existing building stock (EC, 2018). Residential retrofits have also been shown to improve occupant health and wellbeing (Curl et al., 2015, Willand et al., 2015), reduce fuel poverty (Sovacool, 2015) and lead to job creation and economic growth (EEFIG, 2015, Washan et al., 2014). Retrofit may also produce private benefits to households, including increased property value (Brounen and Kok, 2011, Fuerst et al., 2015), significant savings in energy bills and improved thermal comfort (Aravena et al., 2016, Gillingham et al., 2009). However, much of this potential remains unexploited.

The lack of investment in seemingly cost effective EE measures, is commonly termed the ‘energy efficiency gap’ (Jaffe and Stavins, 1994). Firms, public sector actors and households are seen to underinvest in EE, due to multiple ‘barriers’ that constrain uptake (Kangas et al., 2018, Sorrell et al., 2004). Although many factors that contribute to a low demand for EE are likely to be outside of what financing alone can achieve (Wilson et al., 2015), tailored financing solutions can make an important contribution to the uptake of retrofit measures (Rezessy and Bertoldi, 2010), particularly in the residential sector (Freehling and Stickles, 2016).

Historically, a large proportion of global investment in residential retrofit has involved either self-financing or energy supplier obligations (IEA, 2017). However, meeting the 2 °C target will likely require third-party sources of finance (EEFIG, 2015), particularly as energy suppliers see their market capitalisation shrink and attempt to de-leverage3 their balance sheets due to declining revenues and market share (Blyth et al., 2015, Bolton and Foxon, 2015). Incumbent energy suppliers also lack incentives to fund EE investments, as their current business model relies on increasing throughput sales of energy (Knoeri et al., 2016). Existing financial institutions, such as banks and institutional investors, also remain reticent towards such investment due to an unfamiliarity with the technologies, regulatory risk, short investment horizons, high transaction costs and a lack of suitable finance mechanisms (Bolton and Foxon, 2015, Hall et al., 2015, Stone, 2014).

The United Kingdom’s (UK) ‘Green Deal’ policy provides an interesting case of an innovative finance mechanism, intended to deliver approximately 2 million retrofit installations per year and leverage billions of pounds of investment. The scheme was based on private sector lending to households, paid back through a levy on energy bills–known as ‘on-bill repayment’ (OBR). However, the scheme only achieved a fraction of its target, and resulted in a significant loss to UK taxpayers before its premature scrappage in 2015 (Rosenow and Eyre, 2016).

A range of more successful retrofit finance mechanisms, however, provide some important lessons (EEFIG, 2015). Examples include the USA’s Property Assisted Clean Energy finance (PACE) programmes (Kim et al., 2012); low cost loans delivered by the German KfW state bank (Schröder et al., 2011); other forms of on-bill-financing and repayment (On-bill) (Zimring et al., 2014a); green mortgages (Ecology Building Society, 2017); and state-backed guarantee funds (Borgeson et al., 2013). In addition, energy service agreements (ESA), where finance for measures is procured upstream by an Energy Service Company (ESCo) as part of an energy saving performance contract have been used in multi-family housing and commercial buildings (Labanca et al., 2014).

Yet, academic studies on alternative approaches to EE finance are largely absent from the energy and climate journals, with leading finance journals largely silent on energy issues in general (Diaz-Rainey et al., 2017). The literature on ‘green finance’ has tended to focus on high level flows of energy finance (Mazzucato and Semieniuk, 2018), or the challenges of funding large renewable energy projects (Blyth et al., 2015). Hall et al. (2016) also highlight the challenges of financing distributed energy systems, where differing national institutional contexts influence the financial solutions available.

A handful studies have discussed the potential of alterative retrofit finance mechanisms, including potential revolving retrofit funds (Gouldson et al., 2015), the UK’s Green Deal (Marchand et al., 2015, Rosenow and Eyre, 2016), and the successful German KfW programme (Rosenow et al., 2013a). Others have explored how energy performance contracts could finance residential retrofit (Winther and Gurigard, 2017) but have not foregrounded the financial component of such models. Bergman and Foxon (2017) discussed the challenges for reorienting finance towards EE in the UK and argue for a re-framing of EE as infrastructure financing. Previous work has also discussed the potential of novel financing solutions for overcoming the spilt incentive barrier (Bird and Hernández, 2012). But taken together, these studies provide only limited insights into what the features of a successful finance mechanism might be. This paper seeks to address this gap in the literature.

3. Features of a finance mechanism and the cost of capital

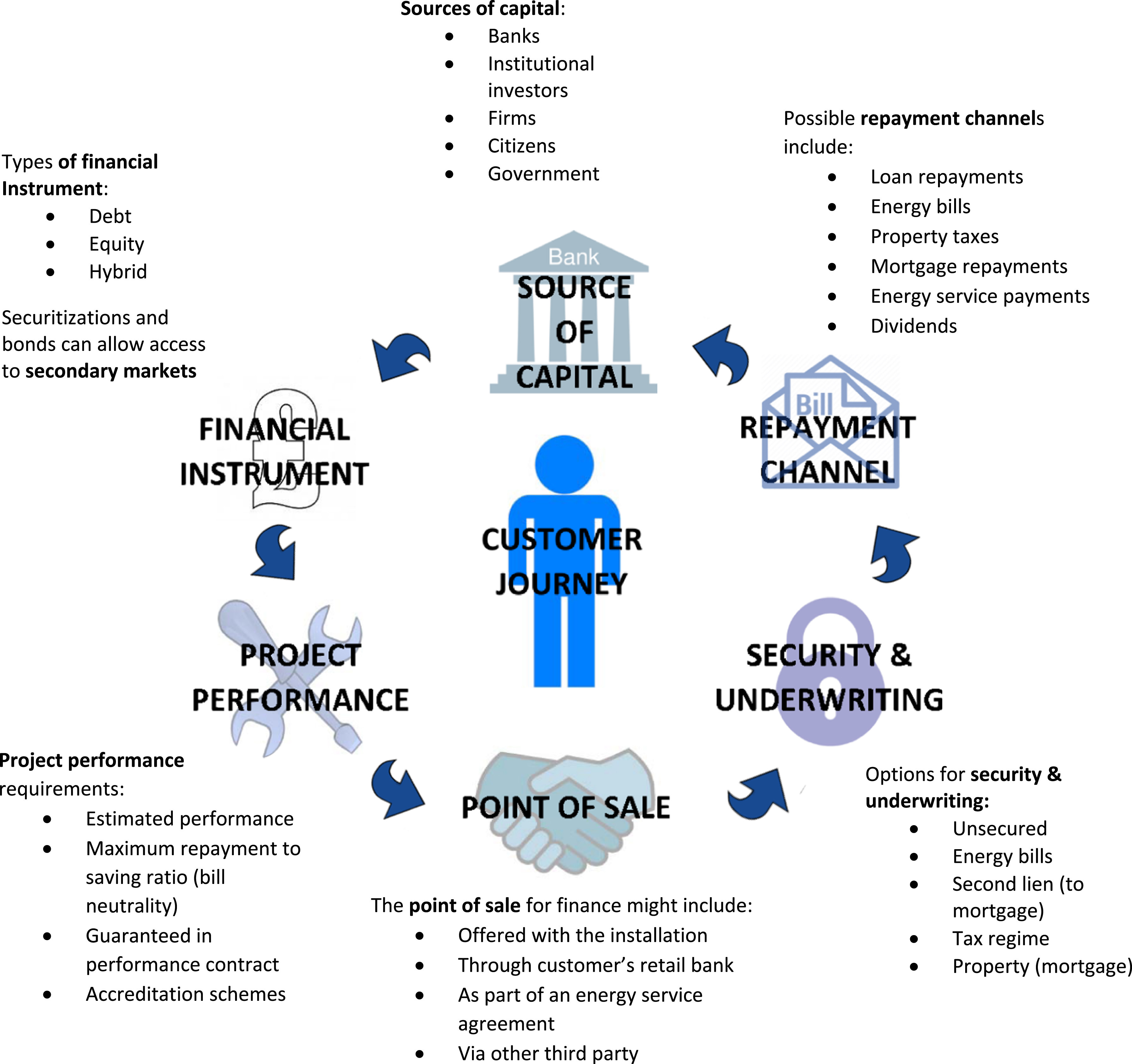

Access to capital and split incentives are a significant barrier to residential retrofit. Often household savings or conventional financing solutions, such as secured and unsecured loans may be unavailable, or unsuitable (Rezessy and Bertoldi, 2010). Many also face split incentives – where the benefits of an investment do not fully accrue to the investor (Bird and Hernández, 2012). The classic example is the pervasive ‘landlord tenant dilemma’, where energy savings accrue to the tenant, with the landlord making the investment. Homeowners may also face split incentives if they move out before their initial investment has been recovered and if the value of that investment cannot be capitalised in the sale price. Thus, many conventional forms of financing4 do not address split incentives (Bird and Hernández, 2012). In response, a range of retrofit finance mechanisms have been developed to overcome these barriers (EEFIG, 2015). Fig. 1 summarises the conceptual framework of key design features of finance mechanisms, which are described in detail in Table 1.

Fig. 1. Process diagram of an EE finance mechanism.

| Table 1 | |

|---|---|

| Feature | Description |

| Source of capital |

|

| Financial instrument |

|

| Project performance |

|

| Point of sale |

|

| Security and Underwriting |

|

| Repayment channel |

|

| Customer Journey |

|

| a) Credit enhancements are a set of approaches usually offered by public actors, which reduce lender or investor risk by providing some form of protection or guarantee in the event of default, bankruptcy or delinquency.

b) Junior Debt is a loan or security that ranks below other loans or securities with regard to claims on assets or earnings. Junior debt is also known as a ‘Subordinated debt’ or subordinated loan. In the case of borrower default, creditors who own subordinated debt won’t be paid out until after senior debtholders are paid in full. c) Many retrofit programmes may be partly based on grants or other public subsides, however the focus of this study is to analyse the dynamics of the finance mechanisms, rather than the influence of grants or subsidy instruments on the underlying economic viability of retrofit measures. d) A special purpose vehicle (SPV) is a company with a specific and often short-term purpose, with a structure and legal status that allows the SPV to fail or go bankrupt without bringing down the wider organisations involved the transaction. They are designed isolate risk and allow organisations to finance projects ‘off balance sheet’. e) Securitisation is a form of financial engineering where groups of illiquid assets are bundled together, often by aggregating multiple smaller securities, and transforming them into a tradable security in secondary markets. f) A secondary market allows for securities (such as loans) to be resold, often in aggregation and are thus second hand. g) Debt is senior to equity, so in a bankruptcy, the debt holders get paid before the equity holders. Therefore, equity providers (shareholders) require dividends that tend to reflect these higher risks with higher associated rewards and are often linked to project profitability. h) The customer journey is defined as the sequence of events that customers experience in order to learn about, purchase and interact with products and services (Norton et al., 2013). |

|

3.1. The features of a finance mechanism and the customer journey

See Fig. 1 and Table 1.

3.2. The cost of capital

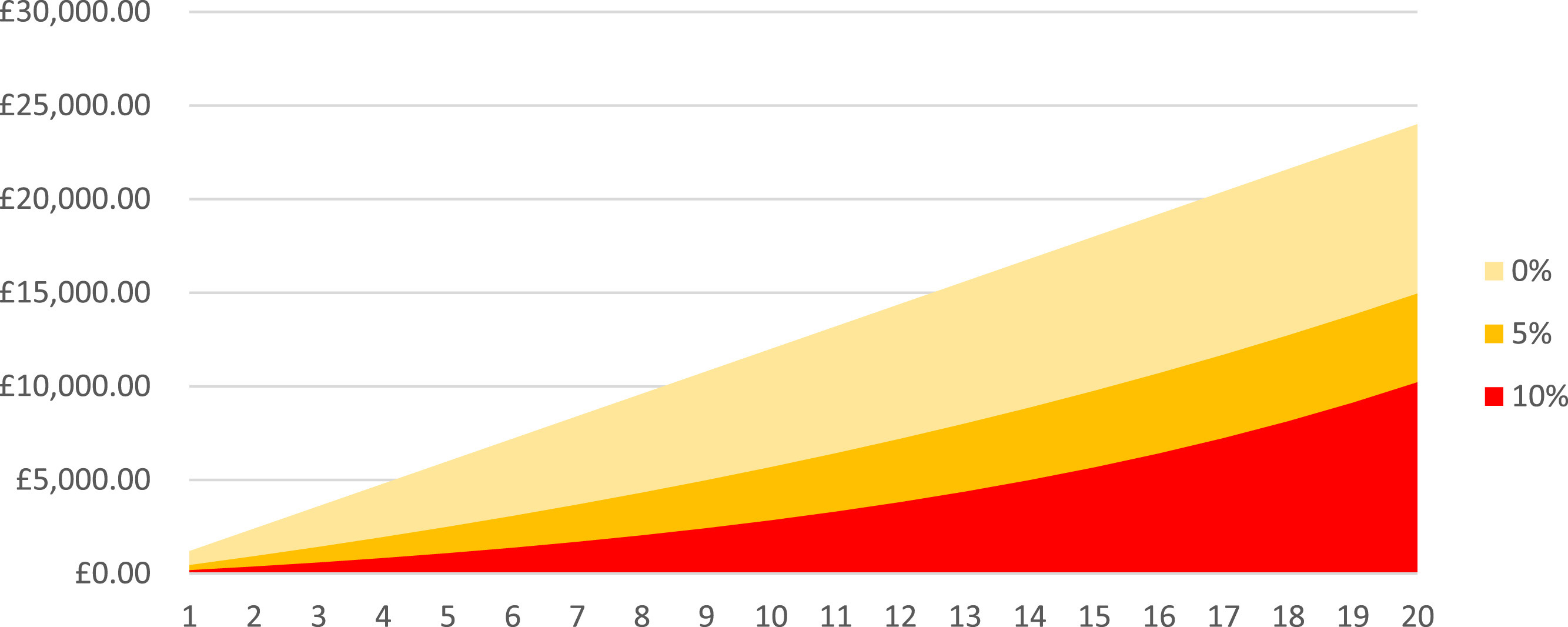

The cost of capital is of critical importance for determining the economics of capital-intensive investments, such as retrofit (Donovan and Corbishley, 2016). The cost of capital consists of the weighted average cost of debt (e.g. the interest rates attached to a bank loan) and equity (e.g. the returns required by shareholders). Due to the effects of compound interest, the cost of capital has increasing significance for long term, capital-intensive investments (Donovan and Corbishley, 2016).

Fig. 2 provides a simple illustration. Assuming a fixed repayment of £100/month and a loan maturity of 20 years, the figure shows the total amount that can be borrowed at 0%, 5% and 10% interest rates respectively. Whilst a household could borrow £ 24,000 (the principal) at 0%, this reduces to £14,954.65 at 5%, and only £10,216.27 at 10% – where at 10% the total interest is higher than the principal. Consequently, assuming fixed payments and loan term, the cost of capital limits the amount that can be borrowed and in turn the extent of the retrofit measures funded.

Fig. 2. The impact of the interest rate on borrowing potential, assuming a fixed repayment and term.

Previous studies show that the interest rates on loans can limit the appeal of retrofit finance mechanisms such as the UK’s Green Deal (Marchand et al., 2015, Rosenow and Eyre, 2016), whilst low interest rates were an important success factor in Germany’s KfW scheme (Rosenow et al., 2013a, Schröder et al., 2011). This high cost of capital is also likely to significantly limit the feasible range of retrofit measures that can be funded (UKGBC, 2014). However, Borgeson et al. (2014) question the extent to which the cost of capital is a barrier, emphasising how high interest credit card financing for retrofit remains prevalent in the USA.

4. Methods

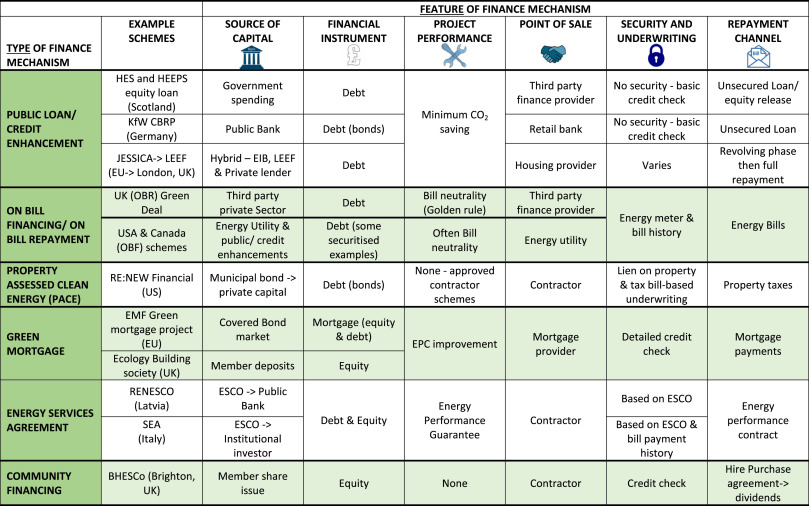

This study takes a qualitative approach, involving analysis of interviews and secondary data, including a comprehensive review of the ‘grey literature’ on EE finance. Whilst there are few academic studies on the topic, numerous policy briefs, publicly commissioned studies and consultancy reports exist from a range of public, private and third sector sources. This review identified several texts with recurring descriptions of the key approaches to retrofit finance in both domestic and commercial buildings (EEFIG, 2015, EST, 2011, Investor Confidence Project, 2015, Kats et al., 2011, Kim et al., 2012, Sweatman, 2012, Sweatman and Managan, 2010, The Rockefeller Foundation and DB Climate Change Advisors, 2012, Zimring, 2014b). Examination of this literature led to the development of a typology of six archetypes of finance mechanisms used to fund residential retrofit in the EU and USA. For simplicity, some archetypes, such as public guarantee funds and state bank loans were aggregated under a single heading, whilst others, such as leasing, were excluded due to limited examples being available in the residential sector. This typology is summarised in Table 2 and described in detail in Section 5.

Table 2. The key features of six archetypes of finance mechanism for residential retrofit.

Subsequently, eighteen semi structured interviews were carried out, split into two phases: ‘expert scoping’ and ‘practitioner’ interviews. During Spring/Summer 2017, eight prominent experts (Table B1) in the EE finance community were interviewed. Several interviewees were authors in the key texts described above, notably the European Commission funded Energy Efficiency Finance Group report (EEFIG, 2015), whilst others were selected through personal contacts and snowballing techniques (Yin, 1994). The aim was to understand the key drivers and barriers for residential EE financing; which design features of a finance mechanism are most important; and why certain approaches are more effective. Information was also sought on how the policy and institutional context shapes the preference for and viability of different approaches.

Building on the insights from the expert interviews, a protocol was developed to interview practitioners pertaining to each of the six finance mechanisms in the proposed typology. The aim was to include at least two representatives of each type, with the sample drawn from the EU and the USA. Many of the mechanisms under study, such as PACE, have only been adopted in certain USA states, notably California. Understanding both the mechanism’s features and the policy and institutional context in which they operate is therefore important. Questions were designed to probe each of the design features of finance mechanisms (described in Section 3), and the drivers and barriers to the adoption of those mechanisms, including broader contextual factors. During Summer/Autumn 2017, ten semi-structured practitioner interviews (Table A1) were conducted.

Interviews were coded using the NVivo 11™ software, allowing common themes to be identified along with areas for further investigation. This qualitative approach was considered appropriate, given the need to develop a rich understanding of the role and importance of different features of finance mechanisms, and their broader contextual setting (Yin, 1994). The pre-testing of the framework with ‘experts’ was intended to prevent key approaches and elements being missed, although it is acknowledged this could introduce bias in the selection of interviewees.

5. Typology of retrofit finance mechanisms

Building on the review of grey literature, a number of distinct finance mechanisms can be identified. These approaches are distinguished by variations in the key features identified in Section 3. The range of approaches to financing residential retrofit was discussed during the expert scoping interviews, leading to the development of a typology of six archetypes of finance mechanism, namely, public loan/credit enhancement, on-bill finance and repayment, property assessed clean energy financing, green mortgages, energy service agreement financing, and community financing. The typology is described in this section and summarised in Table 2. The following types are drawn from prominent contemporary examples and their nomenclature reflects common terminology within the industry. The typology is ordered from the more widespread publicly funded approaches, to the more niche community financing.

Some overlap exists between the different archetypes, with the possibility that hybrid forms may emerge.

5.1. Public loan/ credit enhancement

Public retrofit finance mechanisms typically involve low cost loans provided by governments, but may also include a range of credit enhancements to be blended with private capital (EEFIG, 2015). The most prominent example is Germany’s CO2 Building Rehabilitation Programme (CBRP). Germany’s state bank, the KfW, provides loans to households arranged through commercial banks. Funds are raised on capital markets,5 and offered at very low rates of interest (> 2%) (Rosenow et al., 2013a). The bank is able to offer these low rates primarily due to its AAA rating; a product of its public status, with additional state funding to further subsidise interest rates (Schröder et al., 2011). In 2007, the CBRP issued €5bn in loans, and the programme is estimated to have reduced carbon emissions from the existing building stock by 24% between 1990 and 2006, with an average of a 59% reduction per property in 2006 (Schröder et al., 2011).

Less well-known schemes are the Home Energy Scotland (HES) loan and Home Energy Efficiency Programme for Scotland (HEEPS) equity loans, funded by the Scottish government. Both programmes offer 0%6 interest loans. The HEEPS equity loan is repaid upon the sale of the property. However, it is more common for public funded programmes, such as the HES and KfW loans, to be unsecured and linked to the individual rather than the property (Zimring et al., 2014a). Both the CBRP and the HEEPS equity loan schemes allow funding for wider renovation measures (Schröder et al., 2011), with the HEEPS equity loan allowing 45% of the maximum £40,000 to be spent on non-efficiency measures (EST, 2017).

Credit enhancements blend public money with private capital in a single fund. For example, the Joint European Support for Sustainable Investment in City Areas (JESSICA) programme, administered by the European Investment Bank, mobilises grants from European structural funds7 (Rezessy and Bertoldi, 2010). Such mechanisms typically involve the low cost public capital occupying the junior (high risk) tranche8 of a fund, which is then blended with private sources (Zimring, 2014b). This reduces risk for the private providers, with the public money absorbing the first losses should customers default. A prominent example is the London & Mayors EE Funds (LEEF & MEEF) (LEEF, 2012). Such schemes aim to leverage high ratios of private to public capital for EE investments with LEEF and MEEF raising £100 m (50:50 private/public ratio) and £1 bn respectively (70:30 private/public ratio) (Amber Infrastructure). Other examples may include loan loss reserve funds and guarantees9 or direct interest rate subsidies (Zimring, 2014a).

5.2. On-bill finance and repayment (On-bill)

On-bill mechanisms involve the repayment of loans via the energy bill (electricity, gas or dual-fuel). The investment is typically secured by the right to disconnect supply, if left unpaid (Zimring et al., 2014a). These approaches are divided into two types, with different sources of capital. On-bill financing (OBF) involves energy bill-payer or public funds, whilst on-bill repayment (OBR) refers to the use of third party, private capital (Zimring, 2014b). In the USA, UK and Canada over 20 on-bill programmes have provided over $1.05Bn of financing to households for EE improvements, delivering $76 m in 2014 alone (Zimring et al., 2014a).

The UK’s Green Deal is probably the most well-known example of OBR and included requirements for energy bill neutrality as part of its ‘Golden rule’, meaning savings had to be equal to or greater than loan repayments. The Green Deal also precluded non-energy measures from financing (7–11% interest rate). The scheme had very limited uptake. Of the 614,383 assessments undertaken, only 15,138 households adopted a Green Deal plan by October 2015 (DECC, 2015), far less than the millions of installations that were hoped for (Rosenow and Eyre, 2016). However, in many cases these assessments may have led to self-financing (Webber et al., 2015).

A range of other on-bill programmes in North America have been more successful. Manitoba Hydro’s public OBF scheme has funded almost $300 m in efficiency improvements in single-family residences since 2001, although 95% of the loans have funded single-measure window, door or furnace replacements (Zimring et al., 2014a). Some smaller scale programmes, such as Clean Energy Works Oregon (CEWO) OBR private finance, have funded whole-house retrofits with loans of up-to $30,000 (Zimring et al., 2014b). Several of these programmes offer reduced interest rates (0–5%) through public funds and credit enhancements, and have very low rates of default (0–3%) (Zimring et al., 2014a).

5.3. Property assessed clean energy (PACE)

PACE was developed in 2007 and allows municipalities in the USA to fund home and commercial retrofit using land-secured special improvement districts (Kim et al., 2012). These are debt instruments linked to a specific geographical area and secured by land or property. Traditionally they are a means of funding municipal infrastructure investments, through an additional charge on the property tax bill, common in the USA. The assessment districts were devised by Benjamin Franklin in the 17th century as a means to fund improvements that meet a ‘valid public purpose’. (Energy Pro). Originally in PACE, local governments funded retrofit measures and attached a tax lien10 (a form of security that allows claims on tax payments) to properties that benefit from the improvement works. Most PACE funding now comes from the private sector, although still uses the bond issuance and tax collection powers of municipal or local governments (Kim et al., 2012). The PACE financing is secured as a senior lien on the property and is re-payed along with other municipal charges and assessments, on the property tax bill – which provides investors with robust repayment security11 (DOE, 2016).

Most residential PACE projects have been concentrated in California, with private providers such as RENEW Financial securitising PACE debt for re-sale to capital markets (RENEW Financial). Residential PACE financing has risen dramatically in recent years, facilitating more than $4 billion in clean energy investments (Leventis et al., 2017), with RENEW Financial achieving an average 28–27% reduction in home energy use on their projects (RENEW Financial). There is currently no national or state requirement for energy bill neutrality within PACE schemes.

5.4. Green mortgages

Mortgage or home equity financing provides the mainstay of extension and renovation funding to existing homes, usually through a mortgage-extension or re-mortgage. Loans are secured to the property and typically have a duration of 25 years or more. However, some mortgage providers offer a range of Green or EE mortgage products designed to provide lending specifically for retrofit.

Mortgage underwriting is based on the applicant’s ability to repay. Whilst a significant proportion of outgoings relate to energy costs, current underwriting methods use arbitrary techniques to determine these costs. Initiatives including the UK LENDERS (2017) and EU EeMAp (2017) projects are seeking to promote actual energy usage data in these underwriting calculations. Thus, lenders may provide increased lending for more efficient properties at reduced interest rates–as the higher disposable income reduces the risk of default (EeMAp, 2017). The LENDERS project estimates that monthly savings equivalent to two Energy Performance Certificate (EPC)12 bands, could equate to around £4000 in additional mortgage finance (LENDERS, 2017). Eventually this may create a modest ‘green premium’, increasing property values for the most efficient properties (EeMAp, 2017), also providing additional borrowing for retrofit measures.

Whilst mainstream European mortgage lenders are yet to offer EE mortgage products, some specialist lenders such as the UK’s Ecology Building Society offer both additional lending for retrofit projects and also interest rate discounts of 0.25% for each EPC improvement level (Ecology Building Society, 2017). In the USA, the Fannie Mae mortgage company’s Green financing for multi-family buildings reached $3.6 billion in 2016, involving preferential interest rates and additional borrowing for energy and water efficiency property improvements (Leventis et al., 2017). The UK government is now looking to promote ‘innovative green mortgage products’ as part of its Clean Growth Plan (HM Government, 2017).

5.5. Energy service agreement (ESA) financing

Energy service agreements (ESAs) are a form of financing to fund energy performance contracts. In a traditional energy performance contract,13 the ESCO implements a retrofit and provides an energy performance guarantee and a commitment to maintain the assets under the contract for a given period. Energy performance contracts have been most common in the public sector, where public actors can access cheap capital and, thus, ESCOs typically provide engineering services without any financial component (Nolden and Sorrell, 2016). Recently energy performance contract and ESCO models have been growing in the small commercial and residential sectors (Labanca et al., 2014). Under an ESA, a finance provider will arrange financing directly with the ESCO or SPV (typically 7–10% interest), with the end user or household paying for measured performance improvements – usually derived from a baseline of past consumption (Kim et al., 2012). This effectively shifts the financing upstream from the household to provide an integrated offer of finance and measures through an energy service charge. In some models the ESCO will initially use its own funds and then sell on the cash flows or ‘receivables’ of proven projects to a third-party financier in a process known as ‘factoring’14 (EEFIG, 2015). In a pure ESA, the third-party financier will fund projects from the beginning, usually via an SPV, where projects are aggregated and sold into secondary markets to institutional investors (SUSI Partners, 2017).

Although in 2014, over $150 m of USA ESCO revenues were generated through projects in public housing, most this was funded using working capital from the housing provider rather than an ESA structure. However, since 2011 PosiGen have offered an ESA for residential solar and EE and completed 8400 projects in the USA (Leventis et al., 2017). The model has also been gaining traction in Europe in the multi-family sector. RENESCO provide an ESA for the deep retrofit and renovation of dilapidated eastern European housing, while Servizi Energia Ambiente (SEA) offers ESAs and energy performance contracts to the Italian multi-family market. RENESCO have invested over €4 m in 15 Soviet-era blocks and are developing a factoring fund with the European Bank for Reconstruction and Development (EBRD) (RENESCO 2015). SEA are currently negotiating to refinance several projects, with financing partners (SUSI Partners, 2017). Several large investment funds are now beginning to become involved in the ESA market, including the UK’s Green Investment Group (2017).

5.6. Community financing

Community financing mechanisms use equity capital from multiple individuals, each providing a small component of funding for a project. Often this involves groups organised around a local geographical area, adopting ‘co-operative type’ legal structures. Typically the number of shares (and votes) an individual can hold is limited (Yildiz, 2014). Projects are funded through a share issue. However, often these shares cannot be easily sold on, requiring long term commitment from project investors, who may value wider community benefits (Yildiz, 2014).

Community finance mechanisms are common for renewable energy, where in Germany, over 500 energy co-operatives with 80,000+ members have invested up to €800 million in solar PV (EEFIG, 2015). Yet, there are a growing number of examples of this being used to fund residential EE projects. The Brighton and Hove Energy Services Co-op (BHESCo) in the UK use a co-operative approach and a low-cost financing offer (5%) to fund retrofits, based on issuing shares to the local community with an annual return of 5% (BHESCo). A number of examples also exist in Germany (EEFIG, 2015).

6. Key features of retrofit finance mechanisms

The following section outlines the key findings from both sets of stakeholder interviews in relation to the features of these finance mechanisms as outlined in Section 3. The discussion draws upon insights from each of the archetypes of finance mechanisms described in the previous section, with the aim of identifying some more generalizable findings. A summary of relevant interview quotes for each feature of is provided in Table A2 in the Appendix.

6.1. Source of capital

Two interviewees felt that government should be the primary source of capital for residential retrofit. It was argued that the multiple social and environmental benefits of retrofits are ‘public goods’, justifying state financing. Equally, government bodies typically have the lowest cost of borrowing and are able to offer the longest term, lowest interest loans to the widest range of customers. It was emphasised that governments already absorbed significant risk in other areas, providing credit guarantees and low-cost loans for a range of sectors from infrastructure to first time house purchases.

However, most interviewees (eleven out of eighteen) considered that the required investment (~ $1.3 trillion to 2035 in the EU (EEFIG, 2015)) could not be met from public sources alone. Indeed, whilst many small publicly funded programmes utilised day-to-day government spending, (such as the HES and HEEPS loans in Scotland), scaling this up could be a challenge. Therefore, many stressed the need to bring in low-cost institutional capital.15 The only scheme to have achieved this at significant scale has been PACE in California, with ESA models being better developed in the commercial sector. Crucial to accessing these sources of capital is project standardisation and the use of aggregation or securitisation techniques discussed in the following sections.

Aside from PACE, leveraging significant private capital for residential retrofit has involved public co-financing and credit enhancement approaches. Programmes such as LEEF/MEEF and some on-bill schemes in the USA use public money to reduce risk for private investors. Through provision of the ‘at risk’ or junior tranche of a fund or project finance structure, these approaches are able to leverage significant sums of private capital and achieve high ratios of private to public investment.

Germany’s CBRP programme is able to overcome the constraints on day-to-day public spending through the use of the borrowing powers of the KfW state bank. Thus, the programme is able to access large amounts of low-cost funding via the capital markets. However, five interviewees described how this approach owes a lot to the specific institutional context in Germany and similar approaches would require significant institutional change in countries such as the USA or UK, where no equivalent banks exist.

6.2. Financial instruments and secondary marketsMost of those interviewed

that the long term, low yield nature of retrofit investments lends itself to debt financing. However, BHESCo co-operative emphasised that community equity finance mechanisms could also play an important role in empowering citizens to engage in retrofit at a local level. Community shareholders may also accept lower returns in exchange for local community and environmental benefits.

EnergyPro in particular emphasised that accessing institutional investor capital is likely to require aggregated financial instruments, such as bonds enabling small loans to be pooled and traded in capital markets. Unlike central governments, state banks such as KfW are less constrained by national fiscal policy and deficit reduction as they are able to issue bonds directly into capital markets (Schröder et al., 2011). Equally EE mortgages can utilise the well-established ‘covered bonds’16 markets, which are used for trading mortgage securities (European Mortgage Federation). Private sector PACE programmes in the USA, have successfully aggregated multiple retrofit loans through securitisation and sold them as PACE bonds into the asset-backed securities market (RENEW Financial).

Achieving sufficient scale was described by six respondents as the key challenge in accessing these secondary markets. Most institutional investors require minimum investments of at least £2 m. Several examples of the ESA/energy performance contract approach have successfully sold on project receivables, often by aggregating several projects once the revenue streams or cash flows had been proven. Therefore, ESA models are an attractive means of bringing in institutional investors, although these models have so far only been used for the non-residential and multi-family markets. To appeal to institutional investors, achieving standardised projects, that can be aggregated and securitised was identified a key challenge by both Energy Pro and the European Mortgage Federation. Ensuring and demonstrating project quality is therefore important for reassuring both investors and households, mitigating the issues associated with the securitisations of sub-prime mortgages during the 2008 financial crisis.

6.3. Project performance

Long-term performance contracts as part of ESA financing structures provide a clear revenue stream that can appeal to investors in a similar way to power purchase agreements for renewable generation. Whilst it was recognised that energy performance guarantees could also be a key driver for households, Joule Assets Europe emphasised, this alone would not be sufficient to reassure private investors. Therefore, standardised procurement and quality assurance frameworks, such as the Investor Confidence Project (2015) for commercial buildings, were seen as important for attracting finance into residential retrofit.

However, requirements for energy bill neutrality such as the Green Deal’s ‘Golden Rule’ was criticised by several interviewees. Such requirements prevent non-energy measures from being funded and obstruct deeper retrofits, particularly at high interest rates (Fig. 2). For example, measures such as solid wall insulation could not be funded under the Green Deal. Restricting the focus to carbon and energy savings was also seen as a major constraint on household demand. Since customers value funding for general renovation work and aesthetic improvements, restricting funding to efficiency measures alone limits the appeal of the finance package. Mechanisms, such as the CBRP and the HEEPS equity loan and PACE to a lesser extent, allow for wider renovation measures to be funded. These schemes also do not impose strict requirements for energy bill neutrality. However, it was noted that this needs to be balanced against affordability concerns for repayments significantly above current energy bills.

6.4. Point of sale

The point of sale for finance, and the ease and availability of procuring financing alongside the retrofit was viewed as critical by all interviewees. The analogy of the purchase of a car or mobile phone was used by several interviewees. In these mature sectors, suppliers provide a financing package as part of their offer to customers, whereas many retrofit programmes, require a separate interface, involving a long and complex application process. This is also usually separated from the process of actually procuring the retrofit measures.

The complexity of schemes such as the Green Deal, with a separate point of sale, is considered to be a major barrier. The success of PACE is partly attributed to the fact that approved contractors can offer financing through the scheme at the point of sale of the retrofit. This means that customers are able to procure the retrofit measures and financing on the same day and from the same person. This simplicity can dramatically increase uptake, although it requires a streamlined underwriting and approval process from the PACE loan provider, usually initially over the telephone. However, challenges remain with contractors’ lack of literacy in financing, and financiers’ lack of literacy in energy efficiency. Equally, Energy Programmes Consortium (USA) emphasised that whilst USA contractors are able to promote certain financing packages, UK contractors must be accredited with the Financial Conduct Authority before they can provide such advice. Similar arrangements exist in other EU countries. These findings highlight the importance of the presentation of the finance offering to prospective households, the levels of trust in the finance provider and quality of information provided.

6.5. Security and underwriting

Different mechanisms require different forms of security and underwriting processes, whilst most public mechanisms are unsecured. Although there are some examples of private unsecured lending, this typically involves a high cost of capital for what is perceived as a high-risk loan without collateral. Both PACE and on-bill approaches involve novel forms of security, tied to the property tax regime and energy bills respectively. Theoretically this leads to streamlined underwriting and draws in people with lower credit ratings – as the debt is secured to the underlying asset, rather than the individual. However, this is not always the case, with one interviewee describing how it could take up to 60 days to get a Green Deal loan. Rapid underwriting and unconventional security can also raise concerns about the appropriateness of offering finance to vulnerable households who would otherwise not qualify for credit. EE mortgage models also require the inclusion of EPCs as part of the underwriting, although is unlikely to add a significant burden on already extensive mortgage eligibility assessments.

Thus, private sector funded mechanisms are likely to require a robust form of security or collateral in order to provide lending at lower interest rates (< 10%). Publicly funded approaches offer greater flexibility on both underwriting and repayment terms so could therefore provide a good option for those in rented accommodation, on low incomes, with a poor credit history, or some combination thereof.

6.6. Repayment channel

The use of an existing repayment channel was viewed as a key benefit of the PACE, on-bill and mortgage-based approaches. Thus, adopting an existing bill that customers are unable to partially pay or refuse to pay the retrofit component of.

Both PACE and on-bill approaches are theoretically transferable to the new occupier of a property, addressing the split incentive issue – although currently PACE finance is only available to homeowners. Equally, mortgage or equity-release approaches such as HEEPS in Scotland, see the remaining debt resolved once the property is sold, through the equity share. Therefore, finance for measures that add value to the property strengthens the case for using mortgage-based financing. However, case studies from the USA have shown that the debt from PACE and On-bill schemes is transferred to the new occupant only about 50% of the time, thus requiring the outstanding payment on sale (Leventis et al., 2017). Further, both Energy Pro and PACE Nation highlighted how the PACE approach would be particularly challenging for the UK given its different system of property taxation and municipal finance.

7. Discussion

This paper introduced a typology of six financing mechanisms currently adopted for residential retrofit across the EU and USA. Developing a novel framework, the paper has further identified six key features of these mechanisms and shown how these contribute to the success or failure of the mechanism. The following section discusses the findings in the context of the literature on residential retrofit and EE finance. It is shown how the six features influence three outcomes that are critical for the successful uptake of residential retrofit: cost of capital, source of value and customer journey. The paper then discusses how the institutional and policy context of different states is likely to shape the viability of these approaches and the policy solutions required.

7.1. Cost of capital

The stakeholder interviews explored the significance of the cost of capital for the financing of residential retrofit projects, particular for more expensive, ‘whole house’ approaches. The impact of the interest rate on household appeal has previously been highlighted by several studies on retrofit finance (Marchand et al., 2015, Rosenow and Eyre, 2016). Typically, deeper retrofits require capital expenditure of at least £15–20,000 (BEIS, 2017) and have payback periods of 20 years or more. Thus, in combination with requirements for energy bill neutrality, higher interest rates may prevent deeper (but ultimately necessary) measures like solid wall insulation from being financed. Although those with sufficient access to capital, or other forms of household borrowing may continue to self-finance retrofits (Webber et al., 2015), a lack of access to low cost finance remains a key barrier the uptake of residential retrofit. These higher costs may be offset by private benefits such as higher house prices (Brounen and Kok, 2011). However, the findings presented here suggest the customer journey and source of value have a greater impact on household appeal.

The results support the view that the state’s ability to borrow cheaply, absorb risks and deliver social and environmental benefits, provides a strong justification for public funding of investments such as residential retrofit (Stiglitz, 1993). However, given the scale of investment required, the extent to which day-to-day government spending alone can deliver this may be limited (Blyth et al., 2015). Therefore, countries such as Germany have funded large scale investment through public banks, offering very low interest rates and favourable loan terms. This builds on previous research on the market-creating and shaping role that state investment banks can play (Mazzucato and Penna, 2016), particularly where such investments are seen as high risk by private finance (Mazzucato and Semieniuk, 2018).

However, in countries without state investment banks, more ‘market led’ solutions are often favoured (Hall et al., 2016). This paper has described several examples of using public money to leverage significant private finance and reduce the cost of capital through tools such as credit enhancements (see Zimring, 2014a). These approaches can also bring in customers who would otherwise not qualify for credit (Zimring et al., 2014c). Whilst this may leverage limited public funds and reduce the cost of capital, some argue that this represents a public subsidy to private capital (Bergman and Foxon, 2017) or a socialisation of risk and a privatisation of rewards (Mazzucato, 2011). However, some form of public support is likely to be required for those with difficulty in accessing low-cost capital or in rented accommodation and fuel poverty (Sovacool, 2015).

Privately funded mechanisms are likely to require robust forms of security or collateral such as mortgage eligibility and repossession (EE Mortgages), property tax default (PACE) and energy disconnection (On-bill). These findings support work such as Blyth et al. (2015) and Hall et al. (2015) on the potential role of institutional investors, such as pension funds in the energy system. Securitisation enables small loans to be pooled and sold through financial instruments such as PACE bonds in capital markets. However, this requires sufficient scale and standardised project performance protocols currently only widespread in the PACE market and ESA’s in the non-residential sector. Therefore, widespread institutional financing of EE retrofit remains largely aspirational at present (Hall et al., 2015).

7.2. Customer journey

In interpreting the findings, this paper draws on the concept of the customer journey (Norton et al., 2013). Whilst the previous section largely concerned with how the features of finance mechanisms affect their appeal to investors, this research suggests the nature of customer journey has a greater impact on household appeal.

A key finding is that the success of schemes such as PACE and KfW’s CBRP owe a lot to the ease of the customer journey in procuring retrofit financing. PACE loans are often sold by the contractor, at the point of sale of the retrofit. The streamlined underwriting of PACE programmes has enabled loans to be approved over the telephone, during the contractor’s sales visit. Equally EE mortgages utilise a well-established process, which is usually essential when purchasing a property, whilst the KfW approach uses the customers’ existing bank and support from accredited project managers. This simplicity is often valued ahead of a low cost of capital by households – helping to explain why expensive credit card retrofit financing remains prevalent (Zimring et al., 2014a).

These findings support previous critiques of the UK’s Green Deal which involved a complex vetting and application process, requiring a separate interface with a third-party provider (O’Keeffe et al., 2016, Rosenow and Eyre, 2016). This complexity may be further compounded when additional policy measures interact with retrofit programmes, such as the smart meter rollout (McCoy and Lyons, 2017) reducing household uptake. This supports arguments for integrated business models for residential retrofit (Brown, 2018), including a financing offer to households alongside retrofit measures (Mahapatra et al., 2013). In an ESA, financing is fully integrated into the energy performance contract, effectively upstream of the client (Brown, 2018).

An important dimension of the customer journey relates to how the information is presented to households and by whom. This research identifies the point of sale as the critical juncture in the customer journey in which to promote both the retrofit measures and the financing package in a clear and compelling way to households. This supports previous research which identifies the significance of how costs and benefits of retrofit are presented to households (Hoicka et al., 2014) and the importance of a trusted and competent advisor in disseminating this information (O’Keeffe et al., 2016, Risholt and Berker, 2013). Our findings therefore suggest that schemes are most successful, when the technical and financial elements of the customer offering are integrated by a single competent advisor – as is the case in the German KfW scheme (Rosenow et al., 2013a).

Adopting a repayment channel, and form of security that is tied to the underlying asset, theoretically enables PACE, on-bill and Green mortgage/equity release approaches to address split incentive barriers (Bird and Hernández, 2012). However, only on-bill mechanisms address the landlord-tenant dilemma. Yet, in many examples from the USA this has not been the case. Outstanding debt on properties with PACE or on-bill loans may need to be settled when homes change hands (Zimring et al., 2014a), although can be partially offset by increased property values (Sayce and Haggett, 2016). The latter, in turn, requires credible labelling schemes to allow the energy efficiency properties to be identified by potential buyers, together with more widespread appreciation of the benefits of energy efficiency for mortgage repayments.

7.3. Source of value

The study demonstrates how successful retrofit finance mechanisms typically involve funding for wider renovation and enabling works as part of the finance package. This builds on contemporary research on residential retrofit, where broader motivations such as environmental concerns, improved comfort and living standards, property longevity and aesthetics are often valued more highly than cost savings (Fawcett and Killip, 2014), or at least act as important drivers for retrofit projects (Kivimaa and Martiskainen, 2018). Thus, in many cases, financing provides a means of ‘addressing a problem’, such as a broken boiler or low levels of thermal comfort. Whilst the desire to save money is often a driver (Marchand et al., 2015), households may be willing to spend more to finance these broader sources of value.

Consequently, mechanisms that have requirements for energy bill neutrality, or only fund energy measures are likely to undermine these motivations. Many of those interviewed regarded the ‘Golden Rule’ element of the Green Deal as a mistake and pointed out that no such requirements are in place for other forms of consumer finance. Equally the narrow focus on energy measures alone, may leave a finance gap for important enabling works. However, there is a need to balance these issues with concerns over affordability (Leventis et al., 2017). Other forms of project performance guarantees such as energy performance contracts, or warranties are however, likely to be valued by both households and finance providers. This supports recent work on the potential for energy performance contracts to be a demand driver for residential retrofit (Brown, 2018, Winther and Gurigard, 2017).

Critically, all those interviewed agreed that barriers for retrofit financing were of secondary importance for driving demand for residential retrofit. Indeed Borgeson et al. (2014) describe: ‘lack of financing is seldom the primary reason that efficiency projects do not happen.’ Thus, financing should be seen as an enabler rather than a driver of demand, with the analogy that in the Green Deal ‘people were sold the loan instead of the car’ (Rosenow and Eyre, 2016).

8. Conclusions and policy implications

This paper presented a typology of finance mechanisms for residential retrofit, including examples that are delivering at scale. The paper develops a novel framework to understand the features of these mechanisms, including; the source of capital; financial instrument(s), project performance; point of sale; security and underwriting and the repayment channel.

These features are shown to implicate three outcomes that affect the success of these finance mechanisms. Firstly, it is shown that a low cost of capital is key to the current economic viability of whole-house retrofits, such as those involving solid wall insulation. This can be achieved through public finance through state investment banks, municipal authorities or the blending of public and private sources through a range of credit enhancements. Alternatively, low cost private financing is likely to require robust forms of security, standardised project performance protocols and access to secondary markets through the aggregation of multiple projects into trade-able financial instruments. Secondly, and perhaps more significantly, mechanisms that reduce complexity by simplifying the customer journey are likely to achieve much higher levels of uptake. Thirdly, by enabling non-energy measures such as general improvement works, schemes can appeal to broader sources of value that are more highly valued by households, often ‘addressing a problem’, such as broken boiler or low levels of comfort.

Most importantly, the paper outlines how the finance mechanism alone is unlikely to be a driver of demand for whole-house retrofit, and so instead should be viewed as a necessary enabler of a much broader strategy. Thus, integrated business models that enable the wider benefits of whole-house retrofits, alongside a range of up-front incentives and minimum standards are likely to be pre-requisites of a successful, ambitious retrofit programme. Consequently, a review of different retrofit incentives and investigation of how policy can support business model innovation, seem important avenues for further research.

This paper has emphasised the scale and importance of financing the low carbon retrofit of residential buildings. Different countries and regions may adopt different approaches based on their specific institutional context, with different approaches serving certain market segments. However, this goal is unlikely to be achieved without a broad strategy to promote demand and build supply chain capacity – only then requiring appropriate financing solutions. This paper presents a template of how this can be done effectively and provides lessons from where it has not.

Acknowledgements

Funding information

This research was funded by the United Kingdom’s Engineering and Physical Sciences Research Council (EPSRC) through a grant to the Centre on Innovation and Energy Demand (CIED), Ref. EP/K011790/1. This research has also received funding from PROSEU – PROSUMERS FOR THE ENERGY UNION project as part of the European Union’s Horizon 2020 research and innovation programme under grant agreement N°764056.

Publication details

Brown, D., Sorrell, S., & Kivimaa, P. (2019). Worth the risk? An evaluation of alternative finance mechanisms for residential retrofit. Energy Policy, 128: 418-430. doi: 10.1016/j.enpol.2018.12.033Opens in a new tab Open access

Banner photo credit: Alireza Attari on Unsplash