Text of an after-dinner talk given by Prof Robert Lowe on 6th July 2022 at St Catharine’s College Cambridge as part of the Summer Event of the Centre for Doctoral Training on Energy Resilience and the Built Environment (ERBE). A video of the talk is available on YouTube.

The text for this talk is based on a longer paper prepared by Robert Lowe & Lai Fong Chiu for the Centre for Research on Energy Demand Solutions (CREDS) 13 June 2022.

Origins of the energy price crisis

The energy price crisis is a complex phenomenon with multiple drivers which play out across a range of time scales. Some of the prescriptions for getting us out of the crisis are likely to make things worse before they make things better, in part because of the multiple mechanisms at work. In this talk I will set out what appear to be the main drivers, and attempt to draw out some of the energy, economic and policy implications for populations of the UK and other western countries.

1.1 The problem of increasing difficulty and cost of extracting oil and gas

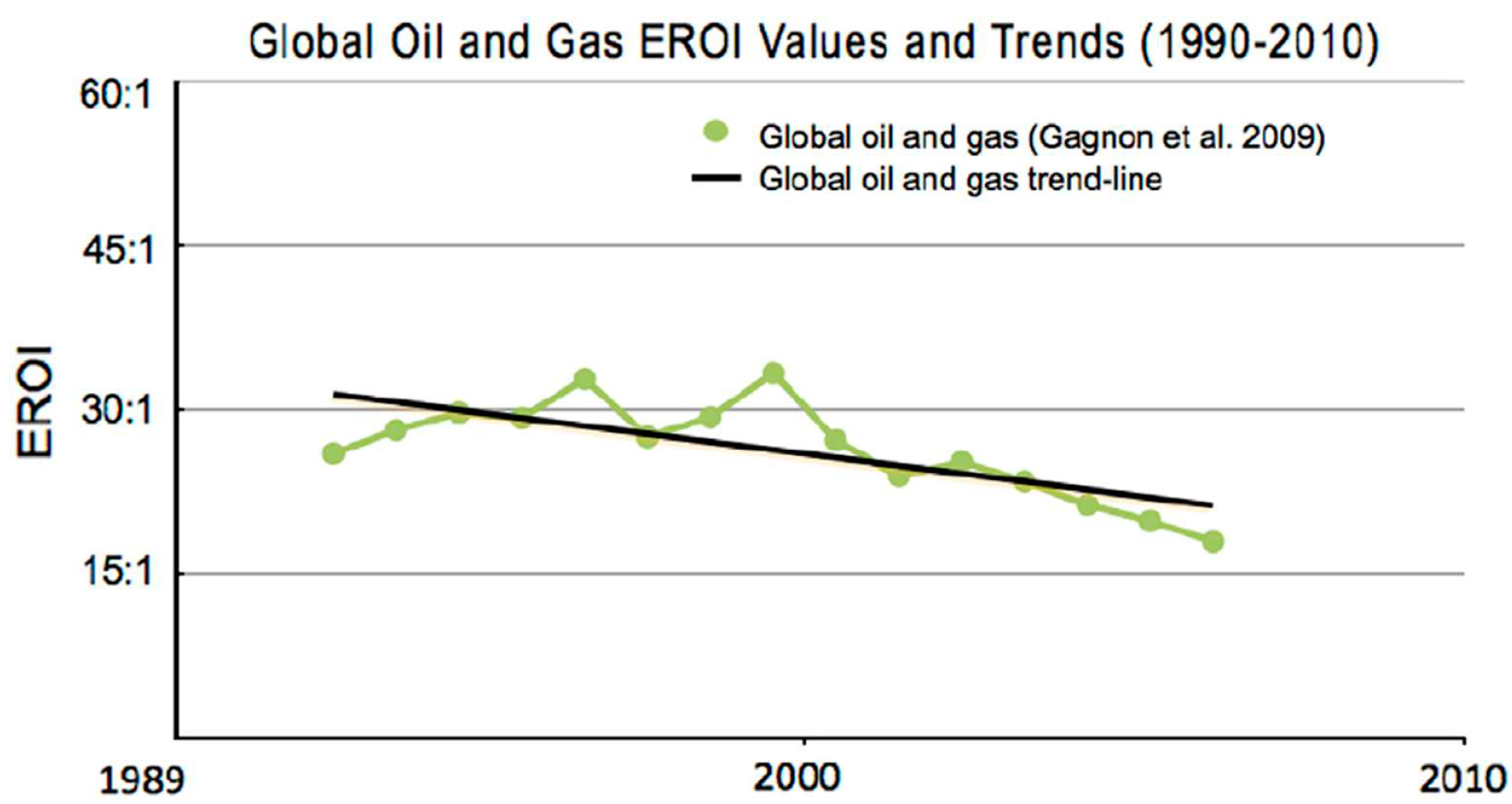

As fossil fuels are extracted, energy and financial costs of extracting them tend to rise. And at some point costs rise so quickly that increases in production can no longer be sustained. This trend was first seen for coal in Britain in the 19th and early 20th centuries – Britain hit peak coal around 1910. We suspect that the long-term decline in productivity of conventional oil and gas, which is being followed by a similar trend for unconventional (fracked) oil and gas, is likely be the underlying driver for many of the economic and political phenomena of the last 20 years. Though the literature around this phenomenon is complex and not definitive (Hall et al. 2014), we speculate that it may be linked to the reduction in interest rates that has occurred over the last 20 years. The phenomenon itself follows straightforwardly from factors related to the statistical distribution of physical size, geology and accessibility of fossil fuel resources, and impacts of these on the timing and economics of discovery and exploitation. Bluntly, there was a very high a priori probability that the largest, most accessible and cheapest fields would be discovered and exploited first. And with minor exceptions, this is what has happened historically. Physical correlates of EROEI, such as length and depth of wells needed to reach unconventional oil are significantly greater than have typified conventional oil through the 20th Century. While extraction technology has improved continuously, such improvements appear unlikely to offset the long term decline in productivity and in energy return on energy invested (EROEI).

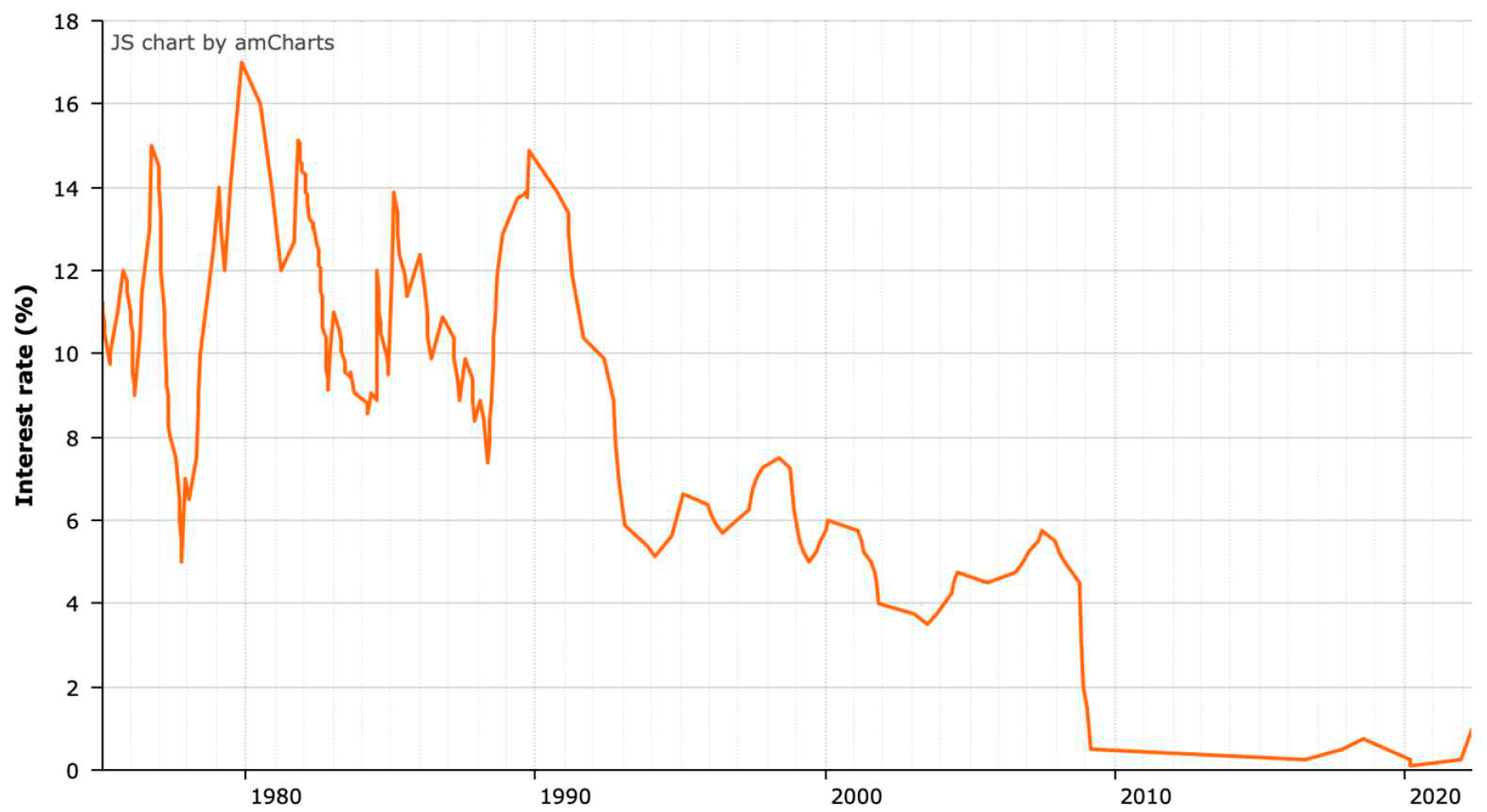

One of the implications of these trends is that more capital has to be invested to secure each new unit of production. A declining interest rate would be one way to fund the increased investment that is needed in oil and gas production while avoiding the need to increase energy prices. The period since 2009 has seen unprecedentedly low interest rates. While the entire causal web by which this has been brought about is unclear, it is possible that some of this decline has been driven by, or is a response to the need to increase investment in oil and gas production. The most obvious direct mechanism for forcing interest rates down has been the injection of unprecedentedly large amounts of money into national economies by central banks. Historically, such policies have led to disaster (Tainter 1988; Fergusson 1975). But it is possible that through their application at global scale coupled with the introduction of unprecedented means of social control, and in the absence of other shocks, collapse might be delayed.

1.2 Switching to renewables as a solution to rising fossil fuel prices

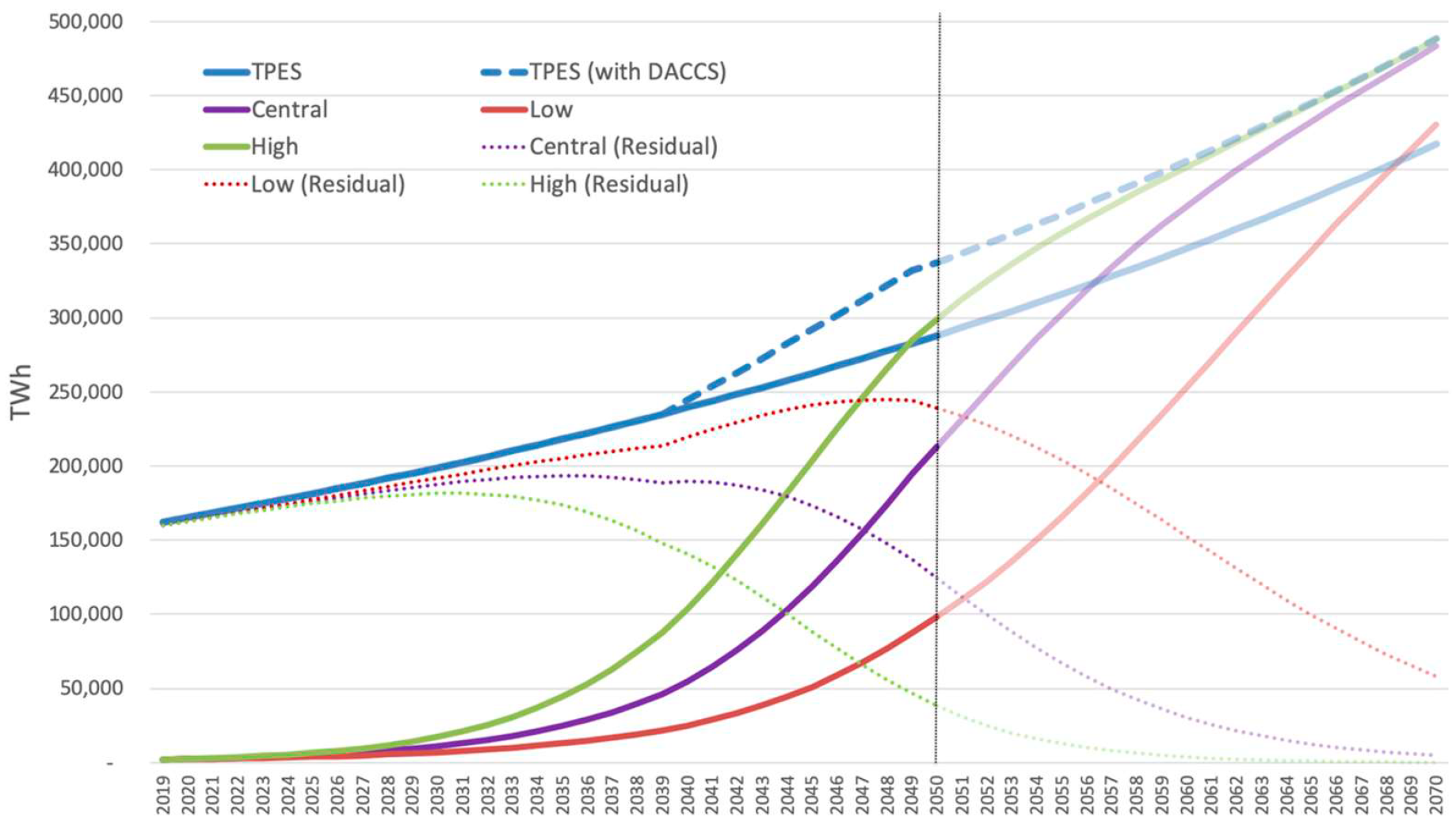

In the long run, it appears that the world can decouple itself from fossil fuels by switching to renewables (Lowe & Drummond 2021). But this cannot happen quickly – certainly, not quickly enough to address the present crisis.

More-or-less all future growth in primary energy production appears likely to come from PV and wind. The main alternatives to PV and wind, biomass and hydroelectricity, are geographically limited, and beset with complexities with respect to land use which are likely to be impossible to resolve. Despite decades of experience, there is no evidence that nuclear fission is in a position to support a large scale transition from fossil fuels. And fusion remains merely a promise.

But although PV and wind power output have each grown at unprecedented rates for the last 30+ years, they still only account for ≈1% of global primary energy (Lowe & Drummond 2022). As a consequence, even if the historically unprecedented growth rates for PV and wind were to continue, it appears unlikely that global fossil fuel demand will peak before 2030. And it appears likely that global oil and gas production will extend well into the second half of the present Century.

The implication of this is that the first half of the transition to renewables will be funded overwhelmingly by the existing fossil-fuelled economy. In addition, the declining EROEI of oil and gas makes it likely that it will require more, not less investment to sustain our existing fossil fuelled economy. From this perspective, attempts in recent years to reduce, or cut off finance to the oil and gas industries appear premature. To the extent that these attempts are successful, they risk leading to economic stagnation and/or contraction, and as a result, damaging rather than stimulating the emerging global renewables sector.

1.3 Geo-political drivers of recent energy price rises

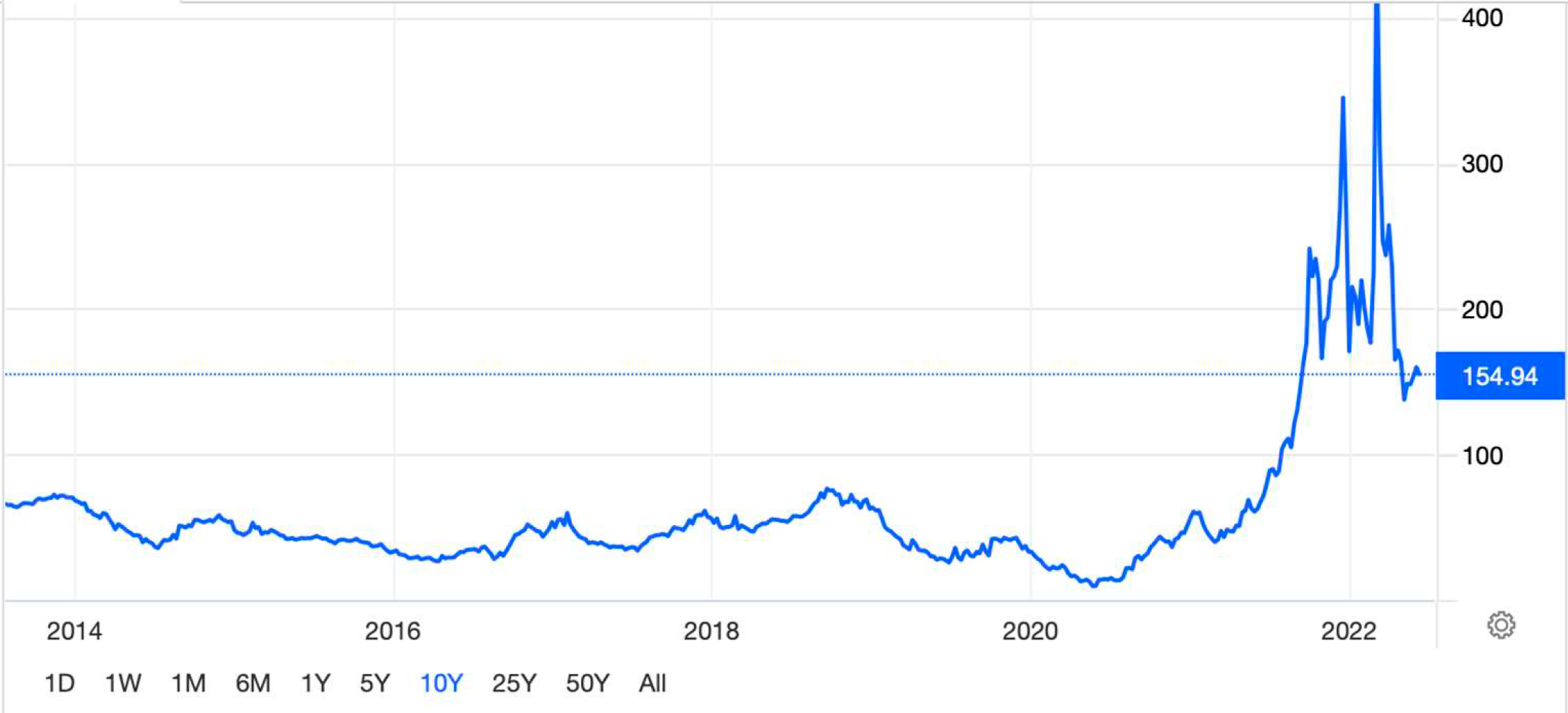

The recent trend to higher oil and gas energy prices began in 2021. The trend therefore precedes the War in Ukraine, and appears to have been driven by a rebound in global and nation economies as they emerged from Covid restrictions. With respect to oil prices, the onset of the War appears as a short transient in February and March of this year superimposed on a more-or-less linear underlying trend.

The situation with respect to natural gas is more complex. The global natural gas market displays much stronger regionality than the global crude oil market, and recent price rises in Europe have been much higher than e.g. North America. While, as with oil, a strong trend to higher prices in Europe predates the War in Ukraine by at least a year, the Russian invasion of Ukraine on 24th February caused the spot gas price to rise to more than double to over £5 per Therm (an Imperial (non-SI) unit of energy, equal to approximately 105.5 MJ.) at the end of the first week in March. The price then fell to around £1.5 per Therm, a level that has been maintained to the 9th June. This is more than three times the average price of gas from 2014 to April 2021. Gas prices are seasonal, and so might be expected to rise again with the onset of colder weather in the fourth quarter of 2022.

Multiple sources of information indicate that the direct causes of most of the impacts of the war on European energy markets result from actions coordinated by the US and the EU to decouple Western Europe from Russian oil and gas. These actions include:

- the seizure of Russian funds located overseas,

- the banning of Russian banks from the Swift Interbank Payments system, thus preventing Western countries paying Russia for energy in US dollars, and

- the refusal by Western Europe to pay Russia in Roubles for its oil and gas exports.

Deprived of mechanisms by which it could be paid by Western Countries for its oil and gas, Russia has increasingly refused to supply them, diverting its exports instead to countries that are willing to pay. At the same time disruption of energy markets has added to the underlying upward trend in prices. The result has, paradoxically but predictably, been to increase Russian financial receipts from overseas sales of natural gas and oil. More than 5 months after the invasion, Russia’s position has been strengthened, while Western European economies are in turmoil. The Western strategy amounts to a reversal of OPEC’s strategy in the wake of the Yom Kipur War of 1973 (Office of the Historian, undated). Then, an oil embargo was implemented by oil exporting countries against oil importers. In 2022, the EU and NATO, major importers of energy, food and raw materials, have voluntarily embargoed a major supplier of all these commodities. To put it bluntly, the West has OPEC–ed itself. As others have pointed out, it is hard to imagine a more obviously self- defeating strategy (Münchau 2022).

One of the consequences of the rise in gas prices that has occurred through 2021 has been a surge in the price of nitrogen fertiliser. This has resulted in reductions and delays in application of nitrogen fertiliser, which coupled with the seasonality of food production means that even if an immediate diplomatic solution to the Ukraine War were to be found, a reduction in global food production this year is now unavoidable. This reduction in production has been further exacerbated by disruption of agriculture in Ukraine, and by disruption to the export of grain produced in Ukraine in 2021. The Governor of the Bank of England, Andrew Bailey recently issued an unprecedented warning of food shortages in the UK (Wallace 2022). The impact of this on the UK population may ultimately be significantly more severe than the direct impact of high gas prices. One of the most recent developments is an attempt by the Dutch Government to enforce a large reduction in the use of Nitrogen fertilizers in Holland. It appears that what we face is not short-term fuel poverty, but long term general impoverishment.

The politics of the Ukraine War are, like the politics of wars going back at least as far as Viet Nam, inevitably and enduringly controversial. Going back further, one might read Christopher Clark’s book, The Sleepwalkers: How Europe Went to War in 1914 (Clark 2012). This documents at considerable length the blundering, second-guessing and mis-communication that led, over the space of just a few years, to the deaths of as many as 40 million people, the collapse of three empires, and ultimately to WWII. In this talk we have deliberately avoided commenting on the causes of this new war. Our piece deals simply with the consequences of the war, and observes that these consequences would likely be minimised – though not avoided – by bringing it to an end by diplomatic means. Perhaps the most important point that we make is that the war is likely to affect the UK population through multiple mechanisms, including things like food and access to paid employment via impacts on cost of transport, general inflation and disruption of supply chains. The impact of the combination of mechanisms is likely to be greater than any of them individually. It is important that we acknowledge that many households will have to contend not with a single energy shock, but with a syndrome of shocks. Even if the war were brought to an end tomorrow, some of its effects, such as the reorganisation of global trade in oil and gas to the disadvantage of the West, are likely to be permanent.

It has been suggested to us that as energy experts, we are not well placed to comment on these developments. But it appears to us that there are in fact very few experts at all these developments. Thus, as energy experts, we are in as good a position as anybody else to comment, and we arguably have a duty to do so, so as to properly contextualise what we have to say about energy.

References

- Anon, 2022. The global fertilizer squeeze: Fertilizer market in uncharted waters amid war in Ukraine and Russian embargoOpens in a new tab PhosphatePrice.com, 6 May 2022.

- Carbonaro, G. (2022) Henry Kissinger: Ukraine should give up territory to Russia to reach peaceOpens in a new tab Newsweek, May 2022

- Clark, C. 2012. The sleepwalkers: How Europe went to war in 1914. Penguin.

- Fergusson, A. 1975. When money dies: the nightmare of the Weimar collapse, pdfOpens in a new tab London: William Kimber.

- Gagnon, N., Hall, C.A.S. & Brinker, L. 2014. A preliminary investigation of the energy return on energy investment for global oil and gas production. Energies, B: 490–503. doi: 10.3390/en20300490Opens in a new tab

- Hall, C.A.S., Lambert, J.G. & Balogh, S.B. 2014. Energy return on investment (EROI) of different fuels and the implications for society. Energy Policy, 64: 141–152. doi: 10.1016/j.enpol.2013.05.049Opens in a new tab

- Klein, G. 2015. Strengthening and streamlining energy advice and redressOpens in a new tab G.K. Consulting for the Citizen’s Advice Service.

- Lowe, R.J. & Drummond, P. 2021. Solar, wind and logistic substitution in global energy supply to 2050: barriers and implications. Renewable and Sustainable Energy Reviews, 153: 111720. doi: 10.1016/j.rser.2021.111720Opens in a new tab

- Münchau, W. 2022. The West and the rest: The world’s economic inter-dependencies are manifold and mutual. Sanctions have large network effectsOpens in a new tab Euro Intelligence, May 2022.

- Office of the Historian, undated. Oil Embargo, 1973–1974Opens in a new tab

- Tainter, J.A. 1988. The collapse of complex societies. Cambridge, New York: Cambridge University Press.

- Wallace, T. 2022. Bank of England warns of ‘apocalyptic’ global food shortageOpens in a new tab Telegraph, May 2022.

Banner photo credit: Asia Chang on Unsplash