Jillian Anable, Kadambari Lokesh, Greg Marsden, Richard Walker, Shona McCulloch and Kay Jenkinson

Introduction

In order to reach a zero-emission transport system it is necessary to transition from a largely fossil fuel powered fleet to a fleet powered by energy sources created from zero emission energy.

For the car and light van markets the transition is predominantly going to be through electrification, with electricity provided from an increasingly low carbon grid mix.

The Government is currently consulting on whether to bring forward the deadline for ending the sale of internal combustion engine vehicles from 2040 to 2035 or earlier.

The timescales over which this transition needs to happen are quite short, and local authorities need to take action now to prepare for this and, where possible and appropriate, to accelerate it.

Although electrification is an essential part of the long-term transition to zero emissions transport, it is not a panacea. Electric vehicles (EVs) today are lower emissions per mile driven than a petrol or diesel equivalent when the emissions from the fuel or electricity are counted (well to wheel).

However, across the whole lifecycle, from construction to decommissioning, an EV today emits broadly the same level of CO2 as an Internal Combustion Engine (ICE) [1]. As production processes shift to using renewable energy the whole life CO2 benefits of EVs will grow, but today there is no such thing as a ‘zero emissions vehicle’.

The realities of price, vehicle availability and consumer choices also influence the rate at which EVs can be brought into the fleet. Even with an accelerated phase-out date of 2032 or 2035 for ICEs, the emissions from the car fleet will still be well above local authorities’ necessary carbon reduction trajectories [2].

There is no decarbonisation strategy which can rely solely on changing the vehicles that people drive, so the uptake of EVs and how this is managed needs to be treated carefully, alongside efforts to encourage mode shift away from the car and to reduce the overall demand for travel [3].

Pro-actively managing the adoption of EVs will also help reduce the risk that cheaper motoring costs from EVs do not lead to more vehicles, congestion and tyre particulate pollution. It will also ensure that charging infrastructure does not undermine accessibility, urban form or place-making goals [4].

This briefing focuses on what local councils could do to accelerate the adoption of electric cars and vans. One of the other six briefings in this series, [5] ‘Growing cycle use’, discusses the role of e-bikes and e-scooters as part of the mobility mix, and it seems likely that other e-micromobility solutions will emerge.

The LGA has been proactively developing policy on EVs and more details and implementation studies can be found on the LGA website [6]. This briefing note integrates EV policy with wider decarbonisation policy.

Relevant policy strands

Road to Zero: this 2018 strategy brought together the key elements of the Government’s electrification strategy.

Home and workplace charge points: grants for charge-point installation at residences and workplaces are also available via the Workplace Chargepoint Grant and the Electric Vehicle Homecharge Scheme (EVHS) [7].

On-street Residential Charge point Scheme (ORCS) provides funding towards 75 per cent of the cost of installing on- street charging points [8]. Local authorities are invited to submit applications for grants of up to £7,500 [8].

Plug-in car grants (PIGC) have been made available by the government via the Office for Low Emissions Vehicles (OLEV) since 2011. This grant covers part of the tag price for brand new vehicles [9].

Company car tax: revision of 2020/2021 company car tax protocols will see that drivers of electric cars, that emit 1-50 gCO2/ km, will be exempt from the benefit in-kind tax [10].

Key facts [11]

Understanding EV adoption

EVs include all variants of plug-in cars and vans including pure battery electric vehicles (BEVs) and plug-in hybrid (PHEV) versions. The key factors which influence consumer adoption decisions are identified below.

The relative cost of EVs compared to ICE vehicles

The purchase price of an EV is roughly £10,000 more than its conventional ICE counterpart. However, the real cost of an EV needs to take account of the running cost, and prospective owners need more information on this.

A study has demonstrated that, with existing purchase incentives, the total cost of owning and running an EV over its whole life is already lower than an equivalent petrol vehicle [15].

However, people tend to hold cars for periods of around four years and so need to make assumptions about the value of their EVs holding up in the second hand market to be confident of the full value for money.

National purchase subsidies remain important to promoting uptake, but there is also evidence that exemptions from congestion pricing accelerate EV uptake [16].

The adoption of Ultra-Low Emission Zones will also serve to concentrate the purchase of EVs in areas where there are air quality problems, to avoid paying the charge. Local influences on the total cost of ownership will play a role in influencing the rate of uptake.

Concerns about whether batteries have sufficient range

Range anxiety – concern over whether or not a car can accommodate an individual’s or household’s lifestyle mobility needs – is a core consideration in any purchase decision.

In surveys, the belief that BEVs will not be able to cope with many journeys still remains one of, if not the, main obstacle to uptake [17]. This is the reason why PHEVs have been much more popular than BEVs in many countries including the UK.

This is despite figures from the National Travel Survey which show 70 per cent of daily cumulative mileages are below 40 miles per day, whilst the range of BEVs being sold into the UK market today range mostly between 150 and 289 miles per charge [18].

However, infrequent long-distance trips for business or leisure exceed these ranges and so range anxiety remains an issue. The scale, convenience, and charging times for public charge points is therefore a potentially important factor for uptake, as part of a package including home charging and fiscal incentives [19]. Other solutions could also be deployed such as linking access to rental vehicles with extended range as part of ownership packages.

Availability of charge locations and charging durations

Most charging will happen at home. The ease of home charging varies significantly between and within local councils. In Leeds, for example, districts have between 10 per cent and 30 per cent terraced housing.

Across the UK only 51 per cent of terraced houses have on-street parking [20]. In Leeds, up to 45 per cent of housing in some districts is in the private rented sector and so the ability of individuals to install home charging infrastructure is limited.

Councils have a role in supporting the development of domestic charging, as we set out below. However, to tackle range anxiety for users, local councils need to intervene to ensure the provision of public charging stations at destinations such as public car parks, shopping centres, and leisure attractions. Special provision may be required for taxi and private hire vehicle (PHV) fleets.

There is evidence that a number of charge points in public areas need to be visible to prospective consumers to alleviate range anxiety and increase confidence in BEVs.

Some of these need to be rapid charge points, but all need to have cutting-edge digital interfaces (charging-system and smart-phone apps) that offer ample guidance and support to BEV users. Once installed, EV parking spaces and charge-points require enforcement to monitor and prioritise access only for EVs.

Whilst there is a long-term market for on- street charging provision, there may be requirements for subsidy in the short run to establish confidence during the early stages of adoption when charge posts could be used infrequently.

| Charging station types | Current type | Power (kW) | Typical charging time (hr) |

|---|---|---|---|

| Rapid | DC | 50+ | 0.5 |

| Rapid | AC | 43 | 0.75 |

| Fast | AC | 7–22 | 3–4 |

| Slow | AC | 3 | 6–12 |

Areas for policy action

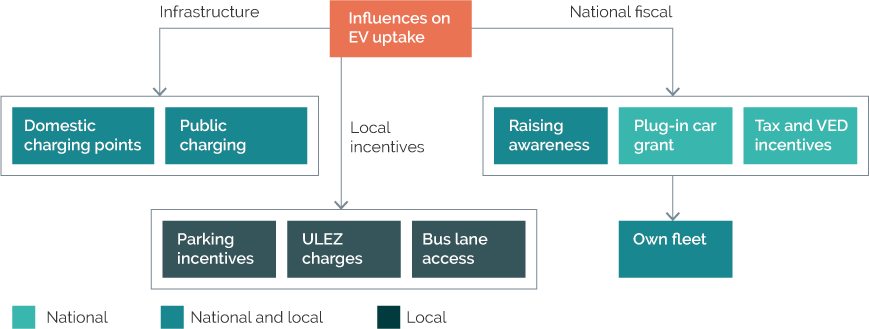

The figure above shows the key areas for action with an indicative summary as to how responsibility for implementation is divided between national and local government.

National government takes decisions on the levels of subsidy for individual vehicle purchases and for tax exemptions for business vehicles. But local government also has a role in raising awareness of these opportunities.

Areas for action by local authorities include infrastructure, awareness raising, own fleet and local incentives. In addressing local incentives, this note also focuses on Low Emission Zones.

Some places have provided EVs with free or subsidised parking, or subsidised electricity during parking, and other places have allowed EVs to access bus lanes. However, there is no strong carbon case for either of these types of measures [22].

Indeed, there are risks that privileging EVs in this way will damage attempts to shift more trips to active travel and public transport – the necessary first step in local councils’ decarbonisation plans [23].

Such incentives may also prove difficult to remove, reinforcing the dominance of the car in towns and cities and working against other objectives.

Action area 1: Charging infrastructure

Proactively plan for on-street residential charging

Councils can undertake analysis of current authority-wide car ownership patterns, in combination with the data on socio- demographic characteristics.

This can be used to identify streets that have both the correct demographic profile for ‘early adopters’, together with on-street parking pressures to locate streets that might benefit from charging points.

Additionally, local councils can set up a scheme for residents to request a charge point in their street to gauge interest from the bottom up, similar to a scheme supported by the City of Amsterdam [24].

There are currently many different innovations and types of residential charge point coming to market, which will suit some environments better than others.

The Energy Savings Trust provides local authorities with funded support via a range of services including the evaluation of roll-out of EV charging infrastructure, business and community engagement, and more [25].

Adapt planning guidance for new housing and businesses

At the time of writing, a response was still forthcoming from the Government to its consultation, ‘Electric Vehicle Chargepoints in Residential and Non-residential buildings’ (June to October 2019).

This could alter buildings regulations so that new housing and commercial developers will need to increase the provision of active charging points at all properties with parking spaces, and that this will no longer be negotiable with local councils.

Some authorities have already taken a position on this, for example, Swindon Borough Council approved draft parking standards (2019) whereby local housing developers are required to install EV charge points.

Slow charge points will be required in residential developments, whilst fast or rapid charge points will be required in retail and leisure areas.

The Swindon standards also specify that developments of new flats with parking must have at least 30 per cent of the parking with chargers and a further 30 per cent with safe and effective cabling infrastructure [26].

Develop a public rapid charging infrastructure

To help overcome range anxiety, local councils can set up rapid charging infrastructure in authority-owned car parks, leisure centres and other facilities.

Councils can also work with businesses, commercial areas and transport hubs such as ferry terminals, airports and rail stations) to set up rapid charging infrastructure.

Early liaison with Distribution Network Operators to understand costs and sub- station capacity is essential. The spring Budget 2020 pledged £500 million for rapid charge network development, managed through the Office for Low Emission Vehicles.

Action area 2: Raising awareness

Citizen awareness

Information alone is not sufficient to influence consumer behaviour, but is vital in combination with some of the other recommendations made here.

One of the problems with environmental information is that it can sometimes make rather generalised statements, not tailored to the local area and the particular choices, issues and environmental trade-offs where people live.

Low Emission Zones, where they are being established, will encourage a range of people and businesses to re-evaluate their vehicles. Linking to relevant information from Low Emission Zone sites will effectively target potential switchers.

Key organisations and user groups Specific user groups such as taxis have their own usage profiles and charge-point requirements. Examples of partnership working include Nottingham City Council, which has instigated a free ‘try before you buy’ 30-day trial of new plug-in hybrid taxis [27].

Bromsgrove District Council has partnered with Engie to install 13 50+ kW charge points as part of its Ultra Low Emission Vehicles Strategy, using funding from the Ultra Low Emission Taxi Infrastructure Scheme.

EV taxi drivers will have free access to the units for the first year, a discount of 75 per cent for years two to five, and 50 per cent for the following five years.

Holding knowledge-sharing events with existing adopters can help with myth-busting and raise awareness of grants for vehicle purchase and charge point installation. As can active engagement with businesses to support the transition of fleets to EV.

For example, The Climate Group’s EV100 initiative helps to develop business models and renewable energy plans to power the transition of businesses to EVs. More than 60 UK businesses are engaged, including OVO energy, FTSE listed Rentokil, Severn Trent since its launch in 2017.

As of 2019, around 80,000 EVs have been deployed by businesses under this initiative, with around 82 per cent of the members charging their fleets with 100 per cent renewable energy via 10,000 newly installed charging points [28].

Action area 3: Local incentives

There are a range of potential discounts or fee structures which can be used to encourage the uptake of EVs.

The UK government has announced plans to give EVs special green number plates, so that they can more easily benefit from local incentives such as free parking, use of bus lanes, and accessing areas cut-off from ICE vehicles. However, as noted above, from an integrated carbon reduction strategy perspective, such privileges have a very weak case.

Where such incentives are used it is essential that there is a clear sunset date announced at the launch, setting out when those privileges will be removed, to ensure that the incentive is clearly understood as a stimulus to early adoption and not an ongoing subsidy.

Discounts will be most effective in areas with Ultra-Low Emission Zones. Whilst ULEZ schemes target air quality and removing the most polluting vehicles, EVs and PHEVs provide a potential compliant vehicle option.

The first six-month evaluation of the London ULEZ estimated a 30,000 tonne (13 per cent) reduction in CO2 emissions as a result of the reduction in traffic and the cleaner fleet operating within the zone [29].

Councils can act to stimulate access to shared EVs through providing on-street sites for car clubs and requiring car club provision as part of planning obligations for new developments [30].

According to an EV usage study undertaken by Enterprise Car Club, 47 per cent of its members (individuals and businesses) have rented electric cars solely to try them out. Meanwhile a third (35 per cent) wished to switch to renting EVs because as a more environmentally friendly travel option [31].

Action area 4: Own fleets

As major employers, movers of goods and people, and procurers of services, there are a wide range of electrification and cleaner fleet options through which councils can show leadership, drawing on the grant funding available.

Whilst there can be additional upfront costs for electrification, the large number of fleets now making a partial or full shift to electric shows that there are medium-term paybacks available in operating costs [32].

The local transition can extend to activities such as retrofitting waste recycling vehicles, as in Sheffield and Westminster [33].

Case studies of vehicle fleet transition are available through the LGA, and further examples and sources of support are available through the Energy Savings Trust [34].

Wider benefits

EVs have demonstrable co-benefits for air quality, as the only air pollution from the vehicle in use comes from the tyres and brakes. The transition to EVs also brings with it the potential for re-skilling local workforces in maintenance, training and sales [34].

However, EVs have lowered the per mile cost of driving. This is currently part of the trade-off with higher purchase costs. However, it still makes the car more attractive relative to public transport and active travel.

EVs are still not zero emission, and not only do they not generate the health benefits which come through active travel (walking and cycling), they take up road space which could often be more efficiently used by buses and cyclists [5,34,35].

As such, EVs create the greatest carbon reductions and co-benefits when they are shared [32] (through car clubs or ride-sharing) and when they are used for trips which cannot easily be made by active travel or public transport.

Conclusion

Electrification of the vehicle fleet is an essential part of the decarbonisation of transport. There is a major push from central government and significant fiscal support to accelerate this, with the phasing out of ICE vehicle sales by 2035 or earlier a distinct possibility.

Councils are key actors in preparing for this through infrastructure provision, planning interventions and own fleet leadership as the market becomes more established.

It is critical to stress however, that whilst this transition is essential, it is not enough, and the benefits of the transition will not be fully felt until the 2030s and beyond.

There are risks that electrification will lower the cost of motoring and make mode shift to public transport and active travel harder to deliver, at a time when this shift needs to be happening more quickly.

Local councils’ electrification strategies therefore need to be fully linked into their wider transport strategies and decarbonisation goals. Any incentives or discounts need to be carefully thought through, as they are likely to subsidise wealthier residents. They should be clearly time-limited if they are justified at all.

There will be important differences between rural and urban authorities. Rural areas have fewer mode shift options available and so will rely more on accelerating EV uptake to decarbonise.

Provision in rural tourist areas has wider benefits in reducing range anxiety for visitors.

Rural councils in particular should set out a clear case for a coherent and subsidised network of charge points.

There is also a need to consider the wider opportunities that electrification might bring. In our briefing note on cycling we point to the potentially transformative benefits of e-bikes, as well as the range of e-cargo solutions now being developed, and intermediate technologies such as electric quadricycles (e.g. the Renault Twizy) [5].

Electrification may yet change the ways in which we plan for mobility and whether the heavy-duty car models of the past are necessary to meet all of our motorised mobility needs in the future.

Notes

This briefing is part of a series written for the Local Government AssociationOpens in a new tab (LGA) and was first published on their website.

DecarboN8 has received funding from UK Research and Innovation under grant agreement EP/S032002/1.

Figure 1: UK electric vehicle (EV) sales in 2013 were 0.13 per cent of total sales. In 2019 EV sales increased to 7.3 percent. Full electric and plug-in vehicle sales were 2.1 per cent in 2019.

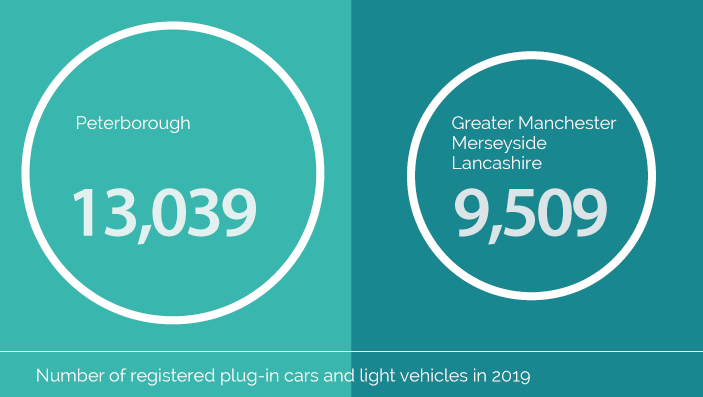

Figure 2: The number of registered plug-in cars and light vehicles in 2019 was 13,039 in Peterborough, and 9,509 in Greater Manchester, Merseyside and Lancashire.

Figure 3: The typical range of EV in 2019 is between 150 and 289 miles per charge.

Figure 4: UPS has ordered 10,000 urban electric vans from Arrival for their delivery fleet.

Figure 5: Policy levers which influence EV uptake are: Infrastructure including domestic charging points and public charging which are both managed nationally and locally; Local incentives including parking incentives, ULEZ charges and bus lane access which are managed locally; and national fiscal levers such as a plug-in car grants, tax and VED incentives, as well as awareness raising at a local level – the national fiscal levers filter down to own fleets at both national and local levels.

Reference

- Hill, G., et al. (2019). The role of electric vehicles in near- term mitigation pathways and achieving the UK’s carbon budget. Applied Energy, 251: 113-111.

- Partnership, W.Y.C.A.a.L.C.R.E., 2020, Tackling the Climate Emergency: Emission Reduction Pathways report. West Yorkshire Combined Authority: Leeds, UK

- Lokesh, K., Anable, J., Marsden, G., Walker, R., McCulloch, S., and Jenkinson, K. (2020). Decarbonising transport: Travelling less and the role of online opportunities. Local Government Association: London,

- Campbell, M., Walker, R., Marsden, G., McCulloch, S., Jenkinson, K., and Anable, J. (2020). Decarbonising transport: The role of land use, localisation and accessibility. Local Government Association: London.

- Lokesh, K., Marsden, G., Walker, R., Anable, J., McCulloch, S., and Jenkinson, K. (2020). Decarbonising transport: Growing cycle use. Local Government Association: London.

- Local Government, (2020). Electric vehicles: Next stepsOpens in a new tab Local Government Association.

- GOV.UK. (2020). Grant schemes for electric vehicle charging infrastructureOpens in a new tab Crown Copyright.

- Energy Saving Trust. On-street Residential Chargepoint SchemeOpens in a new tab

- GOV.UK. (2020), Update on plug-in vehicle grants following today’s budgetOpens in a new tab

- Bates, J. and D. Leibling. (2012). Spaced Out: Perspectives on parking policy: London, UK.

- Office of National Statistics, (2020). Internet access – households and individuals, Great BritainOpens in a new tab

- Next Green Car. Electric vehicle market statistics 2020 – How many electric cars in UKOpens in a new tab

- GOV.UK (2020). All vehicles (VEH01)Opens in a new tab

- Next Green Car (2020). NGCs EV pricevsrange comparisonOpens in a new tab

- Palmer, K., et al. (2018). Total cost of ownership and market share for hybrid and electric vehicles in the UK, US and Japan. Applied Energy, 209: 108-119.

- Whitehead, J., J.P. Franklin, and S. Washington. (2014). The impact of a congestion pricing exemption on the demand for new energy efficient vehicles in Stockholm. Transportation Research Part A: Policy and Practice, 70: 24-40.

- Alix Partners (2019). International Electric-Vehicle Consumer Survey 2019Opens in a new tab

- Next Green Car, (2020). NGCs EV pricevsrange comparison.

- Held, T. and L. Gerrits. (2019). On the road to electrification A qualitative comparative analysis of urban e-mobility policies in 15 European cities. Transport Policy, 81: 12-23.

- Bates, J. and D. Leibling. (2012). Spaced Out: Perspectives on parking policy: London, UK.

- Next Green Car, (2020). Charging points map UK – Electric car charge pointsOpens in a new tab

- Heidrich, O., et al. 2017. How do cities support electric vehicles and what difference does it make? Technological Forecasting and Social Change, 123: p. 17-23.

- Marsden, G., Anable, J., Lokesh, K., Walker, R., McCulloch, S. and Jenkinson, K. (2020). Decarbonising transport: Getting carbon ambition right. Local Government Association: London.

- City of Amsterdam, (2020). Charging and parking electric vehiclesOpens in a new tab

- Energy Saving Trust, (2019), Positioning chargepoints and adapting parking policies for electric vehicles. Energy Saving Trust.

- Swindon Borough Council. (2020). Swindon is charging ahead with plans for an electric vehicle futureOpens in a new tab

- Nottingham City Council, (2020). Electric taxi trial – try before you buy. Transport Nottingham.

- Beard, J., et al. (2020). The Climate Group: EV100 Annual Report 2020. The Climate Group: United Kingdom.

- Greater London Authority, (2019). Central London Ultra Low Emission Zone- Six Month Report: Greater London.

- Campbell, M., et al., (2020). Decarbonising transport: The role of land use, localisation and accessibility. Local Government Association: London, UK.

- Fleet News (2017). Car clubs ‘drive interest’ in electric vehiclesOpens in a new tab

- Centrica Business Services. Driving emissions out of Centrica’s fleet. Centrica Business SolutionsOpens in a new tab

- Air Quality News, (2019). Sheffield powers up electric bin lorries with its own waste. Air Quality News.

- Local Government Association, (2020). Leeds: Fleet transition to zero emission – home charging (opens in a new tab). Local Government Association.

- Campbell, M., et al., (2020). Decarbonising transport: The role of land use, localisation and accessibility. Local Government Association: London, UK.

Publication details

Anable, J., Lokesh, K., Marsden, G., Walker, R., McCulloch, S., and Jenkinson, K. (2020). Decarbonising transport: Accelerating the uptake of electric vehiclesOpens in a new tab Local Government Association: London. Open access

Banner photo credit: Alireza Attari on Unsplash